Upbit, one of the largest Korean crypto exchanges in terms of trading volume, has received a partial three-month suspension for violating industry regulations.

This development is the result of regulatory measures against the platform following South Korea’s move to launch an antitrust investigation against the Upbit exchange.

Upbit suspended for regulatory violations in South Korea

The South Korean authorities have sanctioned Dunamu Company, the owner of Upbit Exchange, for violating regulations regarding the trade in virtual assets. Local media reported on Tuesday that the offenses included entering into transactions with unregistered virtual asset companies.

Upbit Exchange also allegedly failed to comply with proper customer verification procedures and failed to report suspicious transactions. As a result, Upbit has been partially suspended from operating for three months.

Specifically, the authorities have prohibited new customers from transferring virtual assets between March 7 and June 6, 2025.

In addition, the exchange is subject to personnel measures and a financial penalty. This development could harm Upbit’s position among Korean crypto exchanges.

In an official announcement on its website, Upbit acknowledged the violations. The exchange has also committed to taking corrective measures to fully comply with legal regulations.

The company apologized for the inconvenience caused to users and assured them of improvements in transaction management. Upbit also said it would monitor the system to prevent future violations.

“We deeply sympathize with the purpose of the recent sanctions by the financial authorities, which are aimed at stably establishing the anti-money laundering system and strengthening the legal compliance system by strict discipline on virtual asset managers,” read an excerpt in the statement.

Despite the sanctions, existing Upbit customers can continue to trade without restrictions. New users can trade, but they are temporarily restricted in transferring virtual assets, including deposits and withdrawals, to external wallets. Upbit also emphasized that the sanctions imposed may change due to regulatory procedures.

South Korea tightens regulation

This regulatory measure is part of a broader effort by the authorities to enforce stricter compliance measures in South Korea’s crypto sector. The recent penalties follow months of increased scrutiny of Upbit.

The South Korean government launched an antitrust investigation into Upbit five months ago. Authorities investigated whether the exchange had engaged in monopolistic practices. In addition, Upbit’s activities were temporarily suspended just a month ago amid allegations of 700,000 KYC (Know Your Customer) violations.

This was a continuation of concerns that had been raised three months prior. As BeInCrypto reported, South Korea’s financial regulator warned Upbit of 600,000 potential KYC violations, prompting further regulatory action.

As Upbit goes through this period of regulatory scrutiny, South Korea is tightening its regulatory grip. The country plans to introduce the second part of its crypto regulatory framework in the second half of 2025.

These adjustments are being made because the country’s population includes a significant number of participants in the crypto market. Specifically, as of November, more than 30% of the South Korean population has invested in crypto.

Although Upbit is now under more intensive scrutiny, the company has also taken steps to comply with changing regulations. Seven months ago, it became the first exchange in South Korea to make a public announcement under the newly implemented Virtual Asset User Protection Act.

This step was seen as a proactive measure to align with the country’s new regulatory framework and improve transparency within the cryptocurrency industry.

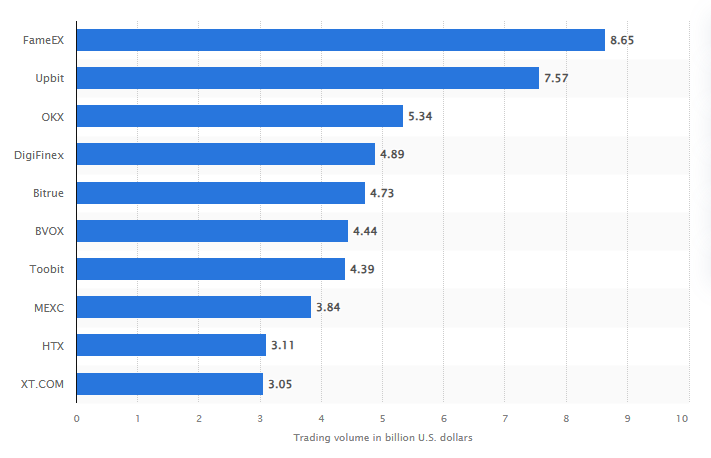

Despite these regulatory challenges, Upbit has historically maintained a strong position in the market. Two years ago, it outperformed major global exchanges such as Coinbase and OKX, and led in trading volumes among Korean exchanges while its American rivals struggled. This dominance reflects the platform’s significant user base and influence within the cryptocurrency industry.