Crypto Market Cap is the basis for evaluating both its value and the size of cryptocurrencies within the constantly evolving digital asset space. Here they give you a snapshot of how much a currency is worth in terms of the total currency circulating supply multiplied by the current price.

To understand how market cap does or does not matter for investors and traders, it is crucial to determine what market cap is.

Key-Takeaways:

- The crypto market cap is a calculation that is used by investors to determine how much a particular cryptocurrency is worth, how dominant it is in the market, and what the risks (or rewards) are of investing in it.

- Crypto market capitalization is theoretical money because it overlooks the invested funds and can change based on token distribution and market manipulation. But use it alongside some other metrics for better analysis.

How Crypto Market Cap is Calculated

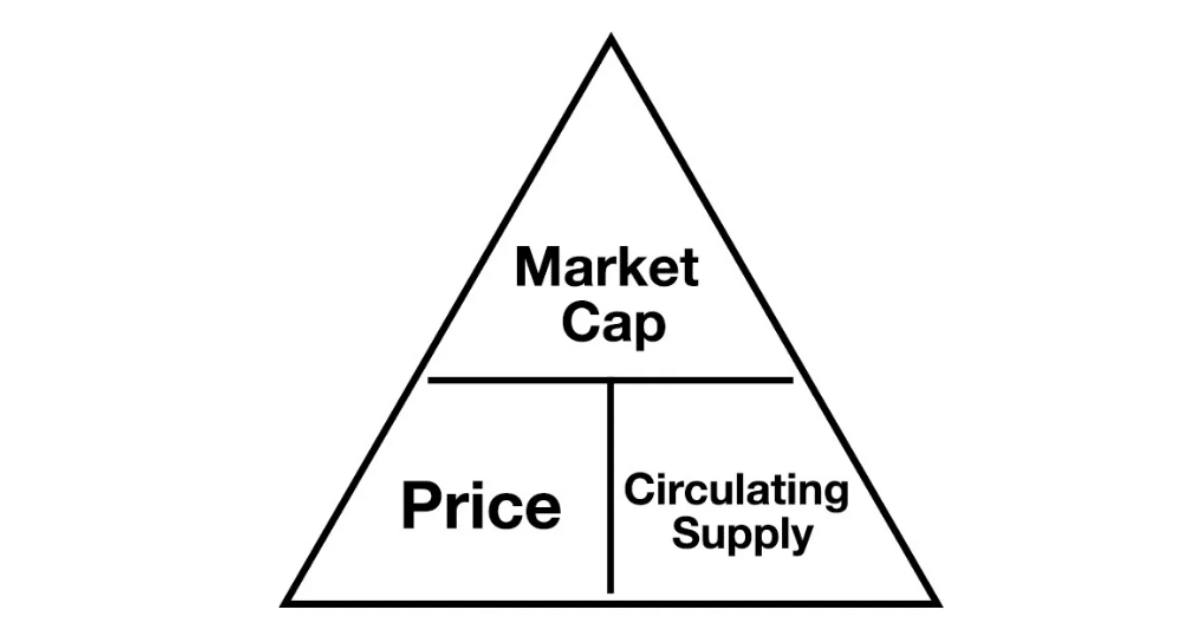

Crypto market cap is based on a simple cryptocurrency formula: current price x circulating supply. For instance, a cryptocurrency trades at $1,000, has 1 million tokens, and it means that the market cap of that cryptocurrency is $1 billion.

Crypto market cap is based on a simple cryptocurrency formula: current price x circulating supply. For instance, a cryptocurrency trades at $1,000, has 1 million tokens, and it means that the market cap of that cryptocurrency is $1 billion.

This metric is used as the baseline to understand the total value and the size of each cryptocurrency in the context of one another. Market cap, as you can imagine, is simple to use for investors, making it easy to compare digital assets based on market dominance, which projects are ruling and which may be in the ascendance.

Additionally, crypto market cap also helps in seeing out the potential risks and rewards of each and every type of crypto. The higher the market cap, the more stability should be noticed, while lower market caps may indicate more volatility but could also hint of a possibility for more risk for investors willing to take more risk.

To gauge the long and short-term potential of digital assets against their instability, a key bit of information to keep an eye on is the crypto market cap. Generally, large-cap cryptocurrencies are more stable and liquid, while smaller capital altcoins have higher chances of growth at the price of greater risks.

In fact, market cap is often combined with other metrics by investors and traders to get a better view of markets. It resolves the issue of well-made vegetation about investment opportunities and diversification portfolios.

Impact on Market Dynamics

That influence of crypto market cap doesn’t just relate to valuations. This metric has a huge impact on:

That influence of crypto market cap doesn’t just relate to valuations. This metric has a huge impact on:

- Trading volume & Liquidity patterns

- Investor and market sentiment

- Volatility levels and price stability

- Measure for Project visibility and adoption rate.

The more a cryptocurrency attains the value of its market cap, the more institutional investors as well as retail traders it would attract. On the other hand, as the circumstances may be in a decline, a crypto market cap could be a sign of lessening confidence or curiosity in a specific digital asset.

Common Misconception and Limitation

Crypto market cap is extremely useful; however, behind this metric there are several misconceptions. One common misconception is that it is exactly the amount of money that an investor has put into a cryptocurrency. In fact, the crypto market cap is the theoretical value of the current market price, not total funds invested.

Crypto market cap is extremely useful; however, behind this metric there are several misconceptions. One common misconception is that it is exactly the amount of money that an investor has put into a cryptocurrency. In fact, the crypto market cap is the theoretical value of the current market price, not total funds invested.

Additionally, factors such as:

- Token distribution, concentration

- Locked or restricted tokens

- Smaller projects market manipulation

- Varying exchange prices

Such influence is what affects the accuracy and reliability of market cap calculations. While crypto market cap can be a helpful part of your analysis framework, investors should keep the limitations in mind.

Conclusion

The crypto market cap is vital to understand the digital assets, but it needs to be observed with factors like adoption rate and market trend. By tracking its movements, we can get insight into market dynamics as well as possible investment opportunities.

When you evaluate your investment opportunities, do you track the crypto market cap so closely? Let us know in the comments.