Since Donald Trump started his government return, America’s cryptocurrency landscape is undergoing major transformation, including the crypto regulations. Under his administration, his team has introduced policies that rapidly change the regulation setup of digital assets. It marks a change in keeping with the promises he had made during his speech at the Bitcoin Conference in Nashville in July.

Key-Takeaways:

- Trump’s administration has gone a long way to reduce regulatory burdens on crypto businesses by making tax reporting simpler, as well as putting an end to ‘regulation by prosecution.

- Despite this, the move to take part in establishing a national Bitcoin Reserve will see the US become the first G7 economy to fully embrace cryptocurrency at the government level.

- Bitcoin seems to be Trump’s F อยค378 design inspiration, as models from Singapore and Dubai embedded minimal crypto regulations and have been wildly successful in attracting blockchain dollars.

- These changes have been received positively by major crypto companies, many of which donated to Trump’s inaugural committee.

Trump’s Crypto-Friendly Approach

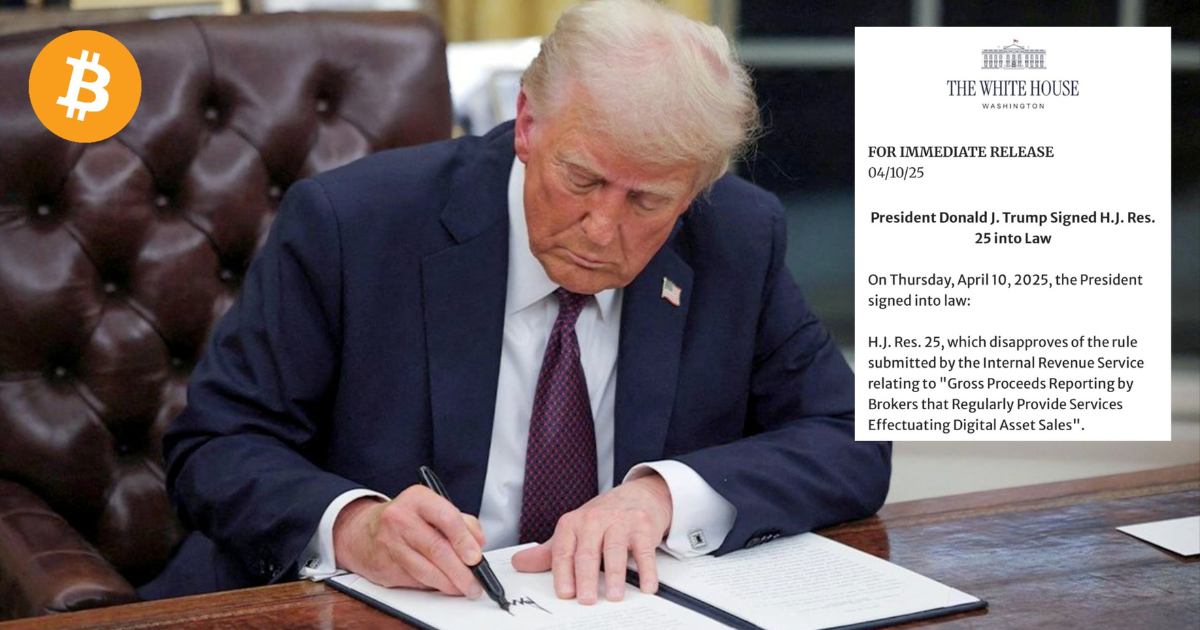

The Trump administration has made considerable headway on easing up regulations on crypto firms. On April 10, the president signed H.J. Res. 25 into law, which makes tax reporting on crypto easier. In the past, with crypto, crypto investors had to deal with some complicated paperwork requirements that were also difficult to complete.

The Trump administration has made considerable headway on easing up regulations on crypto firms. On April 10, the president signed H.J. Res. 25 into law, which makes tax reporting on crypto easier. In the past, with crypto, crypto investors had to deal with some complicated paperwork requirements that were also difficult to complete.

The team that was formerly the Department of Justice’s charge of cryptocurrency companies has also disbanded. Although there is a shift here, it means law enforcement in the future will not target virtual currency exchanges, mixing services, or wallet providers for users’ own actions. Instead, their efforts will concentrate on “regulation by prosecution” (pursuit of ‘regulation’ through actual criminal behavior rather than by lawmaking) rather than ‘regulation by law.’

The March guidance came from the Office of the Comptroller of the Currency as well. In removing these barriers, this guidance allowed banks to begin offering cryptocurrency services. Therefore, it makes for a more welcoming environment for the adoption and innovation of crypto.

Modeling Success from Global Crypto Hubs

Trump’s approach seems to be following in the footsteps of successful crypto-friendly regions like Singapore, Dubai, and the Cayman Islands. Singapore stayed away from excessive regulations to become the world’s third-largest blockchain investment center. Similarly, Dubai was able to draw hundreds of crypto companies to clear regulatory frameworks.

Trump’s approach seems to be following in the footsteps of successful crypto-friendly regions like Singapore, Dubai, and the Cayman Islands. Singapore stayed away from excessive regulations to become the world’s third-largest blockchain investment center. Similarly, Dubai was able to draw hundreds of crypto companies to clear regulatory frameworks.

Now, these companies make a huge contribution to Dubai’s economy, as they are responsible for 15 % of Dubai’s foreign direct investment. In other words, these models are being successfully adapted to the American context, as the Trump administration appears to be doing. The objective of this strategy is to make the US the lead player in the global crypto marketplace.

The Bitcoin Reserve Strategy

Trump is shifting gears by trying to establish a national Bitcoin Reserve. If this happens, the United States will be the first G7 economy to support cryptocurrency, the first in actuality at the national level. Lawmakers across the board have rallied around the strategy.

Trump is shifting gears by trying to establish a national Bitcoin Reserve. If this happens, the United States will be the first G7 economy to support cryptocurrency, the first in actuality at the national level. Lawmakers across the board have rallied around the strategy.

In fact, Trump has suggested including a number of cryptocurrencies beyond Bitcoin in this strategic reserve. However, none of his plans include Ethereum (ETH), Cardano (ADA), and Ripple (XRP). The nation has followed in the footsteps of smaller countries such as El Salvador, which has crammed more than 6,100 Bitcoin into its strategic reserve.

Personal Interest and Industry Response

These policy changes are to the advantage of the Trump family. American Bitcoin is a new bitcoin mining venture owned by Eric Trump and Donald Trump Jr. It is an unprecedented move for the family of a sitting president.

These policy changes are to the advantage of the Trump family. American Bitcoin is a new bitcoin mining venture owned by Eric Trump and Donald Trump Jr. It is an unprecedented move for the family of a sitting president.

And these changes have been a positive thing for major crypto companies. Coinbase, Kraken, Ripple, Robinhood, and Circle—all of them donated to Trump’s inaugural committee. Within a short time of Ripple’s contribution, regulators filed charges against the company linked to XRP.

Trump’s crypto policies are focused on ensuring that profitable jobs, mining operations, and infrastructure are brought to the country. Since Trump was reelected six months ago, bitcoin’s price has surged over 30 percent. The increase coincides with Bitcoin’s four-year bull market cycle and may spawn further growth.

The administration also wants to indirectly benefit America’s economy by embracing dollar-denominated stablecoins. However, these digital assets are still pegged to the US dollar, which could strengthen the dollar’s position in the foreign markets.

Conclusion: Trump’s Crypto Regulations

The nature of these policies is too early to tell what the long-term effects will be, but the administration is adopting a markedly different approach to crypto regulations than has been done before. Concrete policy changes and regulatory adjustments seem to be making America a “bitcoin mining powerhouse,” as envisioned by Trump.