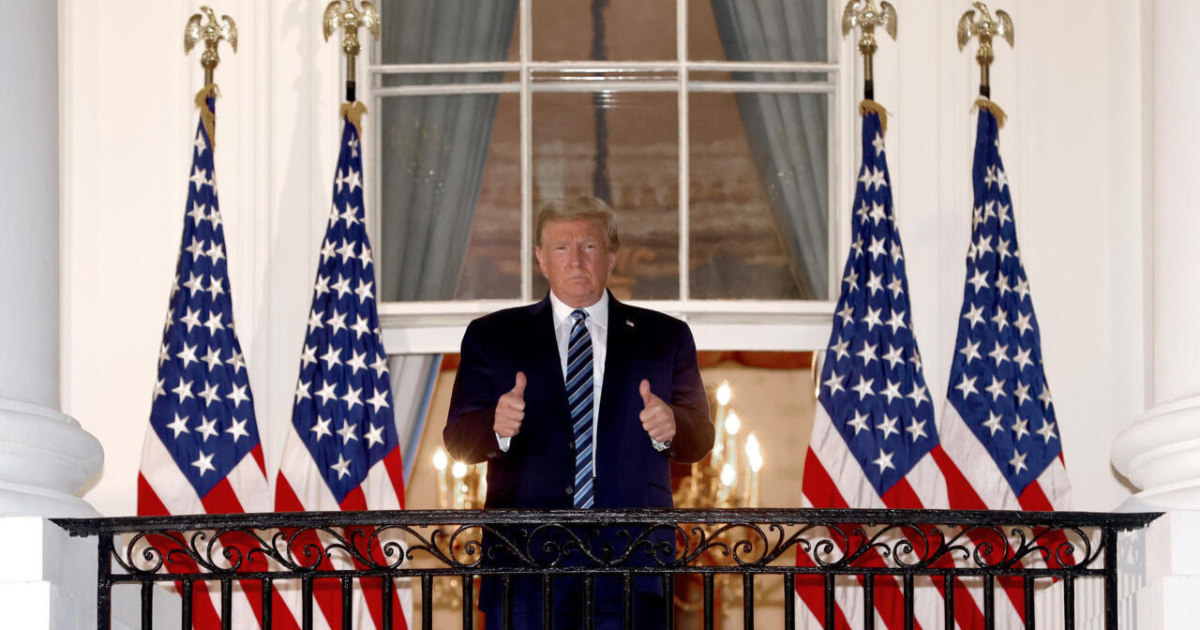

The cryptocurrency world is in the midst of intense discussion about a possible Donald Trump return to the White House. His proposed policies are coded as the potential 47th President of the United States in Trump Agenda 47. This notably positive stance for digital assets and cryptocurrency markets appears to make up most of the agenda.

Key-takeaways:

- A pro-crypto stance seems likely if Trump returns to office, but that will take time and careful regulation.

- 59 percent more financial advisors are likely to invest based on what’s going on, with that figure jumping up to 56 percent more, with more than half (59%) of investor relationships currently focused on crypto.

- There may be upside ahead if the market is not fully priced in to Trump’s impact.

The Trump Agenda 47

The cryptocurrency landscape has a discussion on whether Donald Trump will come back to the White House. His proposed program as the 47th President of the United States is Trump Agenda 47. Among the agenda, there have been additions and a recent focus on digital assets and cryptocurrency marketplaces.

The cryptocurrency landscape has a discussion on whether Donald Trump will come back to the White House. His proposed program as the 47th President of the United States is Trump Agenda 47. Among the agenda, there have been additions and a recent focus on digital assets and cryptocurrency marketplaces.

Trump’s crypto-friendly stance is being watched carefully by financial experts to see how it might impact the digital currency landscape. A recent poll indicates growing faith in financial advice towards cryptocurrency investments. Overall, more than half of advisors are now more positive about investing in crypto following political developments in the past few weeks, Bitwise claims.

Arguments Brewing within Trump Agenda 47

Market analysts are arguing whether or not Trump’s ability to impact crypto prices has already been priced into current prices. The possibilities haven’t quite taken effect within the market just yet, according to Dan Gambardello. This also leaves a chance for investors to reach when they suspect the market is going to move in a positive direction.

Market analysts are arguing whether or not Trump’s ability to impact crypto prices has already been priced into current prices. The possibilities haven’t quite taken effect within the market just yet, according to Dan Gambardello. This also leaves a chance for investors to reach when they suspect the market is going to move in a positive direction.

The changes in regulation of cryptocurrency might not happen immediately after a potential inauguration. The transition period could impact agencies like CFTC, OCC, and FDIC. Regulation and oversight of cryptocurrency play an important role these organizations take on.

Previous Projects and its Projections

For cryptocurrency markets, Trump’s previous presidency was quite mixed. But some opportunities and then some challenges were created by his administration’s ambiguous regulatory approach. In a departure from previous rhetoric, Trump has endorsed digital assets and opened himself up to a potentially different approach.

For cryptocurrency markets, Trump’s previous presidency was quite mixed. But some opportunities and then some challenges were created by his administration’s ambiguous regulatory approach. In a departure from previous rhetoric, Trump has endorsed digital assets and opened himself up to a potentially different approach.

The existing crypto investors have strong confidence in current data. Almost all of the current cryptocurrency investors intend to sustain or increase their holdings. Potential cryptocurrency growth also looks like an under opportunity for traditional financial markets.

Experts say high hopes are tempered by expectations of swift policy change. There was time and coordination required to implement crypto-friendly policies. In short, you should consider both short-term volatility and long-term potential.

Conclusion: The Trump Agenda 47

As it stands, markets could be adversely affected by Trump’s potential presidency, but there won’t be any kind of immediate change. Investors should not expect that implementation will occur overnight. However, like the market, it’s constantly evolving to cope with potential political and regulatory changes. What are your thoughts regarding Trump Agenda 47 and him establishing pro-crypto regulations for the US? Let us know in the comments.