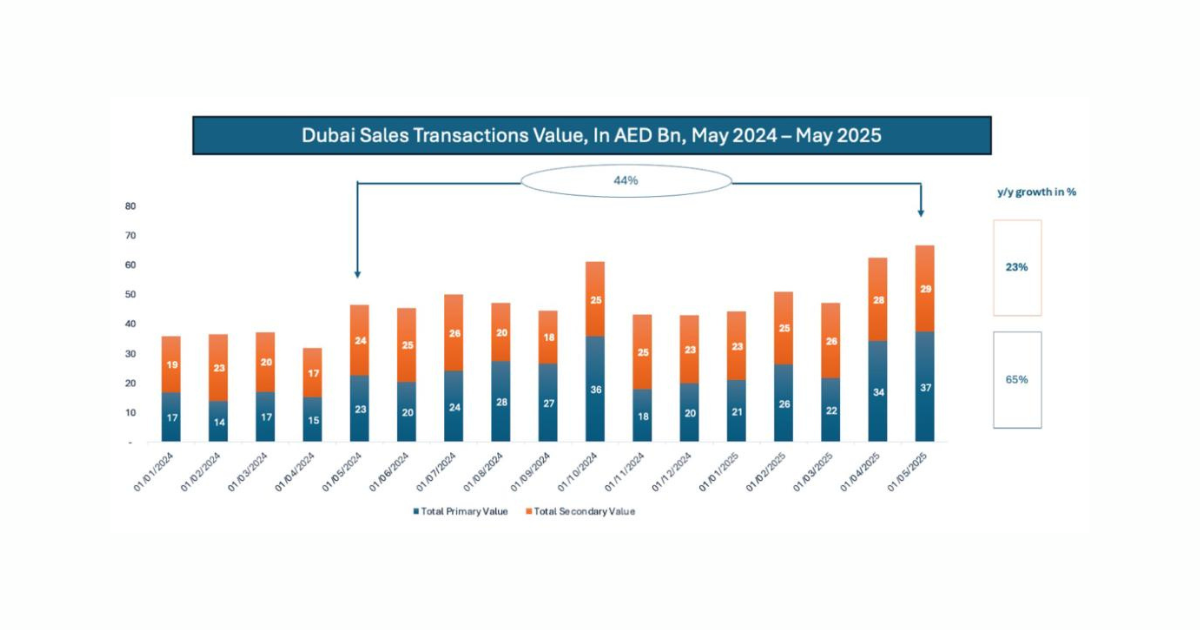

In May 2025, the value of Dubai property sales soared to $18.2 billion, resulting from a total of 18,700 transactions. Year over year, the value of transactions increased by 44% and the number of transactions went up by 6%. This highlights a rising interest from world investors in Dubai. The emirate is establishing itself firmly on the property front.

Key-Takeaways:

- There were total property sales in Dubai worth $18.2 billion in May 2025, which is a 44% increase from the previous year’s value and only a 6% increase in the number of transactions.

- Investors and developers trust the market because of the favorable regulations and a significant growth in primary sales.

Tokenization Reshapes the Area of Property Investment

Property Finder’s latest information shows that property sales in Dubai amounted to 66.8 billion dirhams in May. The increase in primary and secondary markets contributed to this high growth in the real estate industry.

There was a huge increase of 314% in primary sales when compared to May 2024. Confidence among investors was clear when the secondary market sales rose 21% in value.

An increase in Dubai property sales is linked to a rise in real estate tokenization, which is transforming how people buy and own property. The record-breaking Dubai Property Sales has given Scott Thiel, co-founder and CEO of RWA tokenization platform Tokinvest, proof that the market is eager for blockchain technology.

“A monthly transaction volume of 60 billion dirhams means the market is very active, fluid, and open to change,” said Thiel. The executive made it clear that tokenization will speed up the improvement of Dubai Property Sales rather than just aligning with market progress.

With real estate tokenization, smaller, cheaper slices of properties can be bought by investors from around the world, making assets accessible to many. Due to this innovation, more people can participate in the market and more investing chances are provided, combining with the standard Dubai Property Sales channels.

The Regulatory Framework Helps the Market Develop

Through regulatory changes, Dubai has now made it easier to connect blockchain and Dubai Property Sales. A major agreement worth $3 billion RWA was made on May 1, bringing MAG, MultiBank Group, and Mavryk together to introduce luxury properties on blockchains under regulated platforms.

On May 19, the Virtual Asset Regulatory Authority (VARA) boosted its guidelines to add full provisions for the tokenization of real-world assets. Such changes make it easier for both issuers and exchanges to introduce and deal with tokenized real estate assets, so there’s a well-structured system for future Dubai Property Sales development.

May 25 saw the launch of the region’s first platform for tokenizing real estate with the help of the Dubai Land Department, Central Bank of the UAE, and Dubai Future Foundation. With this initiative, investors can get tokenized shares in Dubai properties that are ready for purchase, making Dubai Property Sales more secure through blockchain.

The good results shown in Dubai Property Sales are a result of general economic trends and the region’s preferred position in drawing foreign investors. The business-supportive environment, advantageous site, and up-to-date regulations help the real estate market in Dubai expand.

Because new project sales jumped by 314%, it is clear that builders are confident and many potential buyers want their offerings before construction. The fact that resales in the secondary market grew by 21% shows Dubai Property Sales are steady and well supported in the market.

Conclusion

While Dubai property sales hit new heights, the city continues to be a leader in integrating blockchain technology. The strong real estate market in the city is shown by the $18.2 billion achieved in May. Advancements in technology and strict rules encourage the growth of the industry. Now, Dubai is recognized as a major place for investments.