The launch of HUMA Finance’s token was followed by a big price drop the next day. Trading gains made when purchasing the native token were wiped out when it fell 45% within the first 24 hours. This significant drop shows just how risky new cryptocurrency tokens can be today.

Key Takeaways:

- On the first day, after the HUMA Finance token was launched, it plunged 45%, from $0.12 to $0.062, even with a lot of trading.

- The goal is to use PayFi Stack to build an alternative to the old, traditional financial infrastructure using blockchain.

- Season 1 airdrop is ongoing for a month and another distribution will take place three months after that.

- HUMA is a governance token and its owners can access rewards from staking along with future benefits in the ecosystem.

Token Launch Through Binance Launchpool

From May 23 to May 26, Binance Launchpool was the first place HUMA Finance appeared. People staked Binance Coin, FDUSD and USD Coin to receive HUMA rewards. After the first launch, the token quickly appeared on top exchanges like Bybit, OKX and KuCoin.

Within hours of the May 26 Token Generation Event, DOT moved as high as $0.12. Yet, gains were not able to last as selling activity grew. At the time of writing, HUMA costs $0.062, much lower than its highest price.

Strong Trading Volume Despite Price Drop

Even though the price has dropped, HUMA Finance still sees a lot of trading. More than $600 million was traded off the token over the previous 24 hours. This heavy amount of trading means people are still interested in cryptocurrencies, despite prices going down.

People are trading the token on many different exchanges. After our observation, we found that many investors still think the project has valuable potential. Yet, the way the price has reacted signals that some earlier buyers are cashing in.

Airdrop Distribution Continues

As the HUMA token launched, the team opened Season 1 airdrop claims for those who qualified. The first 5% of the total token supply will go to early adopters during the airdrop. After the launch, you have one full month to add your game to the claim.

In addition, the project plans a second airdrop at around the same time next quarter. Those eligible will be given 2.1% of the total amount of tokens in this future release. The airdrops are given out to encourage people to engage early with the project and to use the platform.

Understanding the PayFi Stack Technology

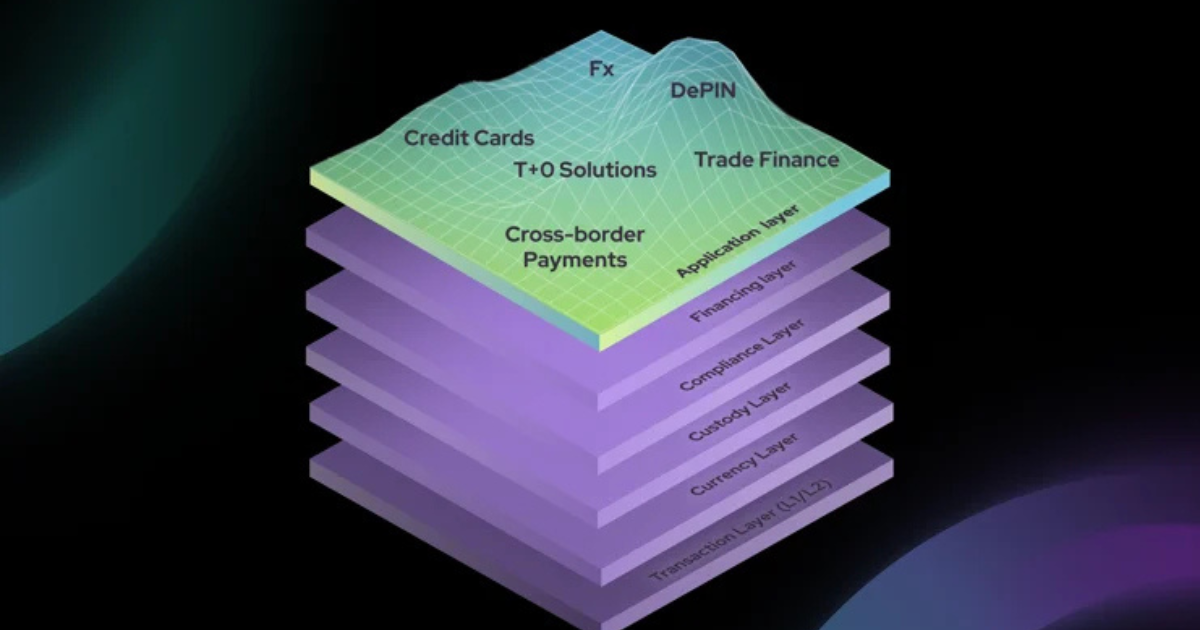

The HUMA Finance team creates the PayFi Stack to solve the challenges that traditional finance encounters. The main goal of the system is to remove old banking systems and replace them with new, programmable ones. This technology stack consists of six parts, each having a different job.

The foundation includes transaction layers and a currency layer that use both Layer 1 and Layer 2 blockchains. Thanks to these layers, payments are processed quickly with little expense. The purpose of the currency layer is to maintain the price stability of stablecoins USDC and PYUSD.

Moreover, the custody service is designed to help manage assets securely with multiple models. The solutions include advanced cryptography put forward by institutions and decentralized smart contracts. Real-time transactions are secure through the use of this system.

Regulatory Compliance and Market Applications

Handling KYC and AML tasks is the main job of the compliance layer. It performs immediate compliance checks that fit the laws in different regions. Europe, Singapore, and Japan provided examples of frameworks to support global accessibility for this study.

By using on-chain methods, financing matches capital to where it is needed in the market. It helps individuals tokenize assets, which means tokens can be designed to manage risks on the blockchain. Executives in the application layer focus on allowing developers to develop different products in the financial sector.

Conclusion: HUMA Finance

HUMA plays various roles in the crypto world apart from having a trading value. It helps decide on changes in the protocol, provides security through staking, and shares tokens with providers of liquidity, borrowers, and users for ecosystem development. Future airdrops could be available to those token holders who have been active. Although prices have declined lately, the project’s applications and technological features indicate the potential for enduring value creation.