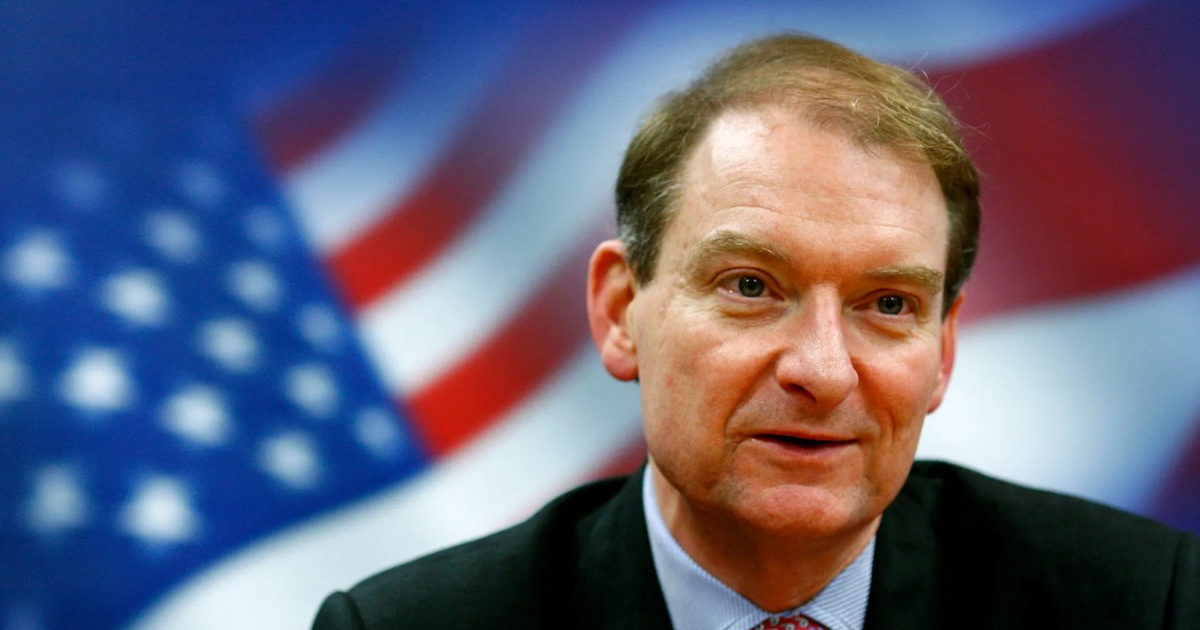

Paul Atkins will be SEC Chairman from April 21, 2025, and the U.S. crypto regulation framework will start to shift. Atkins is seen as a pro market, bringing a new face to digital asset regulation needed now more than ever. It is a crucial time in which regulatory clarity is needed for the developing cryptocurrency industry.

Key-Takeaways:

- Atkins who leads the SEC, from April 21, 2025, is focused on balanced, crypto-friendly regulation of high importance and a major change compared to the past leaders.

- The ruling that will signal the direction of the industry is how Atkins brushes off over 70 crypto ETF applications which have pending requests.

A Changing of the Guard

The new leader, Atkins, was an SEC commissioner from 2002 to 2008, and succeeded Mark Uyeda, who served on an interim basis when Gary Gensler left. After the Senate confirmed his appointment in early April 2025, Atkins was appointed by President Donald Trump in December.

The new leader, Atkins, was an SEC commissioner from 2002 to 2008, and succeeded Mark Uyeda, who served on an interim basis when Gary Gensler left. After the Senate confirmed his appointment in early April 2025, Atkins was appointed by President Donald Trump in December.

Bye Gary, the new face of SEC: Paul Atkins

🏛️ 1980s: Corporate lawyer, Davis Polk (NY, Paris)

🇫🇷 1988: Admitted as legal advisor in France

📊 1990–1994: SEC staffer under Breeden and Levitt

💼 Mid-1990s: Led Bennett Funding fraud recovery

🧑⚖️ 2002–2008: 1 of 5 SEC Commissioners… pic.twitter.com/oikm1AU8uF— Lawrence Samantha 💫 (@LawrenceGS) April 22, 2025

As part of his swearing-in ceremony at the Oval Office, Atkins declared digital asset regulation as a ‘top priority’ for his chairmanship and would be looking to work with President Trump to find a solution. More notably, he had committed to ‘provide a focal point for digital assets with a clear, rational, coherent and principled approach.’

Atkins’ arrival is viewed by the cryptocurrency community as a breath of fresh air, and the community has responded positively to his appointment. SEC Chairman Paul Atkins will be good for Bitcoin, according to Michael Saylor, who is an early Bitcoin adopter and executive chairman of Strategy (formerly MicroStrategy).

SteelWave Digital Founder Mitchell DiRaimondo said Atkins will “bring clarity in a time that the whole space needs it the most” in describing the importance of this leadership change for this industry’s future.

Crypto community agrees with the sentiment, a tweet has been trending across the network, which has always been pushing for a more balanced crypto regulation framework.

One of the biggest things that Atkins has to overcome from the start is the backlog of more than 70 cryptocurrency ETF applications filed to the SEC.

Part of these proposals is to launch products with the backing assets like XRP, Litecoin, and Solana, and the handling of such will shed a lot of light on which direction crypto regulation will be taken by him in the leadership.

Atkins is a member of the Token Alliance and a prominent investor in the blockchain ecosystem, so he may not be as likely to be hostile to innovation as his predecessor, which might help speed through the approval of pending applications that way.

Atkins’ propositions to regulation diverge significantly from those of recent SEC chair Gary Gensler, who many in the crypto sector took as too aggressive and antithetical to digital assets. Among the outrage over the SEC’s enforcement-first approach, many attorneys charged that Gensler and other chairmen lacked clarity.

As a corporate lawyer at Davis Polk in Paris and New York, a French legal advisor, and SECC corporate staff under Breeden and Levitt, he has a diversity of experience.

His deep experience with financial regulation gives him extraordinary insight into the Crypto Regulation Framework and for it to be reshaped to achieve the balance of innovation against investor protection.

Future Direction and Challenges Ahead

Openly, Atkins has sounded the line for modernizing the SEC and bringing cryptocurrency operations to the United States to become “the best and most secure place in the world.” It helps to align with the Trump administration’s broader objective of leading America to become a global crypto hub.

Openly, Atkins has sounded the line for modernizing the SEC and bringing cryptocurrency operations to the United States to become “the best and most secure place in the world.” It helps to align with the Trump administration’s broader objective of leading America to become a global crypto hub.

Atkins is believed to be gradually taking on a more nuanced stance on the Crypto Regulation Framework that accommodates a technology of blockchain and digital assets that is different from other types of technology.

Atkins may choose to replace these innovations with laws written for outdated securities laws or simply try to develop tailored regulations to address the actual risks and potential inherent in cryptocurrency.

Though optimism is on the rise, Atkins still has a long way to go to create a Crypto Regulation Framework.

The complexity is increased by the fast pace of universal adoption of blockchain technology and the spawning of new use cases, while coordination with such agencies as CFTC and the Treasury is also indispensable for a consistent and unified strategy for regulation.

The balance between investing in the investors and there being a balance to encourage innovation will remain delicate. If enforced too much, regulation will suffocate growth, while if too lenient, it will leave the consumers to the sharks.

Conclusion

As the SEC leads Crypto Regulation Framework with Paul Atkins now, things are about to take a turning point. Pro-business attitudes and nailing the blockchain can provide long overdue clarity. Atkins’ approach may soothe fears of the crypto space maturing, helping the U.S. lead or lose out. Is this new leadership going to achieve industry balance at last?