The XRP settlement between Ripple Labs and the SEC appears imminent on the horizon, as both parties have paused legal appeals and appear to be preparing for a deal. On April 10, both parties filed a joint request to halt pending appeals in a joint court filing.

So many now speculate that the settlement could come as soon as April 16, 2025, when Ripple’s next legal response was expected.

Key-Takeaways:

- Ripple and the SEC filed to pause existing appeals, signaling a potential deal by April 16 following new SEC leadership and rising institutional activity.

- Boosting XRP price and its chances of becoming the first to achieve an ETF approval, and most importantly influencing future U.S. crypto regulation, may result from the settlement.

Main Factors Driving the XRP Settlement Negotiations

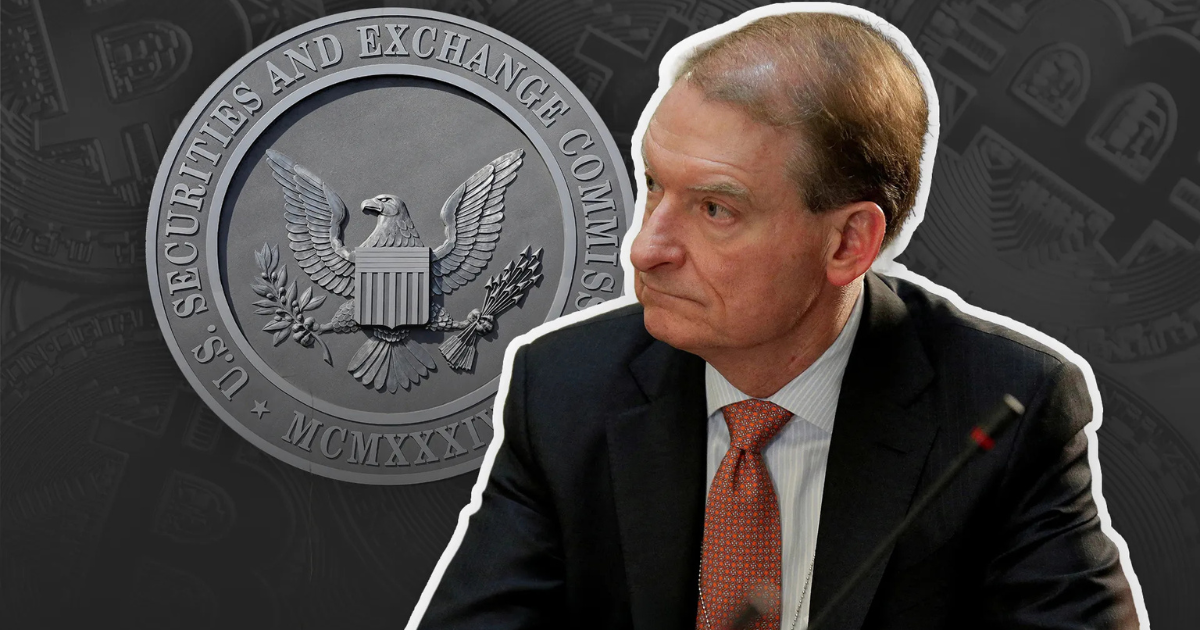

Several important developments have emerged in the XRP settlement process. The most interesting of them is Paul Atkins was appointed SEC Chair on April 9, marking a potential shift in regulatory stance, as he is known for supporting crypto.

Several important developments have emerged in the XRP settlement process. The most interesting of them is Paul Atkins was appointed SEC Chair on April 9, marking a potential shift in regulatory stance, as he is known for supporting crypto.

Simultaneously, unusual market movements indicate that perhaps institutions are preparing for a deal. John Squire, an analyst, noted reasons for serious negotiations, including the resurfacing of institutional wallets and rising whale activity.

The case against the Star is being painted by Attorney Fred Rispoli. Ripple has a 90 percent chance of a settlement or full case withdrawal; therefore, he estimates he has a 10 percent chance of the case proceeding to an appeal.

A potential XRP settlement has a much greater market impact than just short-term price movement. At the time of writing, XRP is trading around $2.06, still a good way below its all-time high of $3.55.

The causes of this gap are primarily due to the cloud of regulatory uncertainty. The absence of that obstacle would be eliminated in a settlement and cause XRP to reassess its potential, thereby driving large gains in price.

An XRP settlement could also help bring about approval for some spot XRP exchange-traded funds (ETFs) much quicker too. All are filed as grayscale, Bitwise, 21Shares, and now ProShares.

These filings could gain momentum if the settlement succeeds in clearing the legal uncertainty. It might be more favorable if Paul Atkins takes over as SEC chair.

A resolved case and new leadership could set the proper path to XRP ETFs. This would mirror what’s already been put in place for Bitcoin and Ethereum ETFs.

Broader Regulatory Implications of the XRP Settlement

An XRP Settlement could have a large and far-reaching impact on the crypto landscape at large. It could put in place some key precedents of how digital assets are viewed and regulated in the U.S.

An XRP Settlement could have a large and far-reaching impact on the crypto landscape at large. It could put in place some key precedents of how digital assets are viewed and regulated in the U.S.

The key part is that XRP may or may not be a security, and it has larger implications. Early indications about the SEC’s future approach under Chairman Atkins could come in the form of a settlement.

The settlement will be watched to see if XRP’s current legal status is clarified. Ripple CEO Brad Garlinghouse has also suggested the case is almost over.

Moreover, the joint filing offers no grounds not to. Finally, any settlement terms will be carefully analyzed, looking for signs that a new regime of crypto regulation is beginning.

Timeline and Expected Outcomes of the XRP Settlement

The XRP Settlement might be speeding up, in fact, it appears April 16 could be the date to pay close attention to. This date may now be pinpointing the official settlement announcement, said to be initially set for Ripple’s appeal response.

The XRP Settlement might be speeding up, in fact, it appears April 16 could be the date to pay close attention to. This date may now be pinpointing the official settlement announcement, said to be initially set for Ripple’s appeal response.

For past actions, experts believe the settlement might involve fines and the potential for such clarity for the future of XRP’s regulatory status. As long as language dictates the terms of setting rules of compliance or defines XRP as a non-security, the market response will depend heavily on that language.

If there is no agreement, then XRP can head south toward $1.70. However, most analysts expect a settlement, and that likelihood has increased with new SEC leaders and the recent joint filing.

Conclusion

The XRP Settlement might be the big ripple, not quite the small wave. These key precedents could be set as to how digital assets should be treated when resolving this long-running case. The eyes of everyone are on April 16 as a possible turning point for XRP and the wider market.