Kraken has now made its crypto derivatives products available to European customers. On Tuesday, the American exchange said it was able to expand due to its recent Cyprus licence. Thus, they can now support perpetual and fixed maturity contracts throughout the European Economic Area (EEA).

Key Takeaways:

- Kraken has introduced crypto derivatives in Europe by using its licence from Cyprus, which allows it to sell perpetual and fixed maturity contracts throughout the EEA.

- The plan is for the exchange to go public by the end of 2025 or the beginning of 2026, with $1 billion in planned debt taken out before the IPO.

- As this cryptocurrency is expanding, Europe is quickly becoming one of the strongest regions for digital asset investment and trading.

- Even as it expands in cryptocurrencies, Kraken is moving into traditional markets by acquiring NinjaTrader for $1.5 billion.

A Cyprus Licence Makes the European Market Available

Before this year, Kraken purchased a local entity in Cyprus that had business links to Pacific Union Group, a contract for different brokers. As a result of the acquisition, it is now a holder of the MiFID II licence. With this, the licence can be used in all EEA countries, boosting the group’s total potential market.

Getting the Cyprus licence is an important first step for Kraken’s plans in expanding across Europe. People living in Europe now benefit from being able to use a wider choice of trading services. This progress occurs during a period when Europe’s digital asset trading market is growing very fast.

New Product Offerings for European Traders

European traders who use Kraken can now trade perpetual and fixed maturity contracts. Using these derivative products makes capital work better and gives access to larger pools of liquidity. With these new offerings, traders are able to use complicated techniques and better manage their holdings.

The European market is very important, believes Shannon Kurtas, Head of Exchange at Kraken. Kurtas pointed out that clients based in Europe tend to be some of the most sophisticated and demanding in the digital asset area. Latin America has emerged as a fast-growing place for cryptocurrency activities around the world.

Path Toward Public Listing

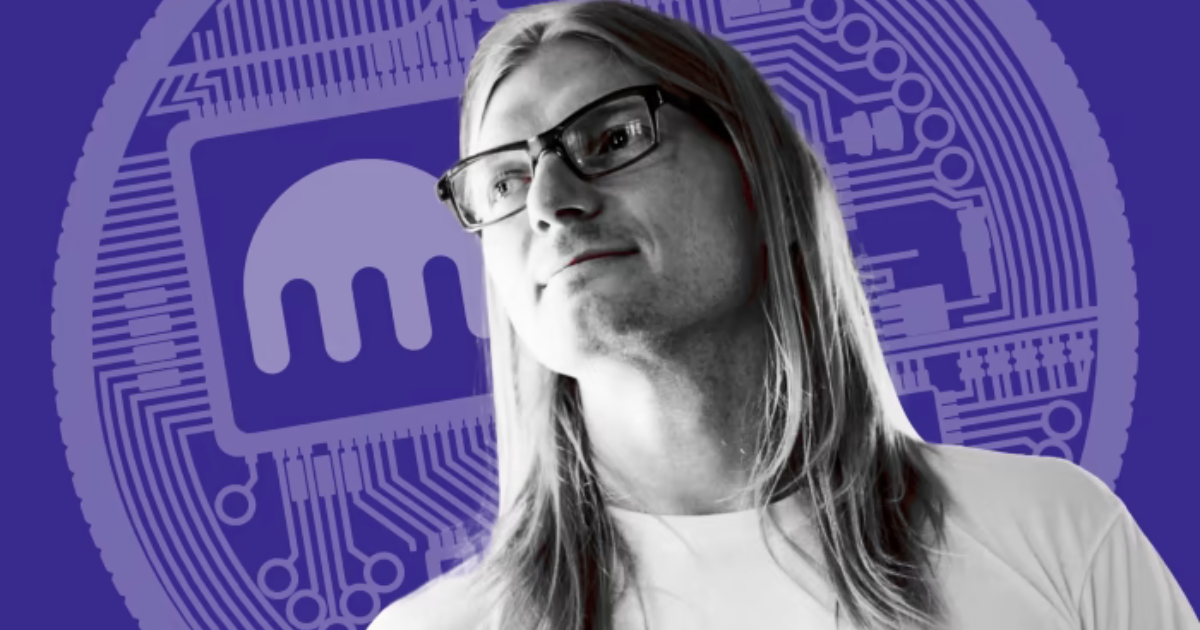

Its European expansion is another step in reaching its goal of an initial public offering (IPO). After Jesse Powell founded Kraken in 2011, the exchange officially launched in 2013 and is expected to go public by late 2025 or early 2026. The exchange, headquartered in San Francisco, hopes to secure about $1 billion in debt financing before its public listing.

If its public launch is successful, they will share the rare honor of being publicly traded with Coinbase as the only other exchange specializing in crypto. Coinbase made history by recently being included in the S&P 500 index. Companies like eToro, which offer strong crypto services, have also recently made their debut on the public market through an IPO.

Diversification Beyond Cryptocurrency

At the same time as offering more crypto derivatives, they are looking to expand into standard financial markets. Lately, the exchange bought NinjaTrader, a popular retail futures trading app, for nearly $1.5 billion. Its purchase of Coinsetter shows that it wants to grow past just being a cryptocurrency business.

It’s different from how some competitors like Robinhood work. The company continues to earn a lot from trading cryptocurrencies, but it is now trying to decrease its focus on them because volumes can vary greatly. Because they are adding new crypto assets and exploring old markets, the company has the opportunity to keep up with changes in finance in the future.

Conclusion: Kraken

Crypto futures are now available on Kraken in Europe, a big achievement for the company. Using its Cyprus license, it has positioned itself to take advantage of the growing European digital asset market. Because of new regulations and additional trading features, European traders now have more reason to select Kraken for their crypto derivative needs. The company’s ambition is clear: to provide all-in-one financial services by expanding and diversifying.