The Tornado Cash case reaches a turning point as a VC firm Paradigm has filed an amicus brief in support of co-founder Roman Storm. It contends that he cannot be convicted unless proved that he had willingly operated a money transmitting enterprise, and it questions the perception of software and transmissions regulation by prosecutors.

Key-Takeaways:

- Paradigm claims that there is a need to prove that Storm was aware he operated a money-transmitting business prior to his conviction

- The short details oppose the prosecution meaning of federal statutes against money transmission

- Storm can receive a maximum sentence of 45 years in prison with trial set on July 14

Legal Proposals Attack Prosecution Theory

The argument provided in the amicus brief of Paradigm in the Tornado Cash Case completely opposes the understanding of the federal laws on money transmission by prosecution. The company maintains that the conviction of Storm should be with concrete evidence that he knowingly ran a business that had user funds in its control.

The prosecution also has to establish that Storm collected transaction fees and willingly accepted criminal money. Paradigm argues that the governmental theory overlooks previously issued guidance from FinCEN that states that a developer who does not have direct access to funds is not a money transmitter.

The Tornado Cash Case focuses on the issue of whether open-source creation of self-custodial software amounts to operation of money-transmitting business. Storm only published code that can never be changed without the control of user funds.

According to Paradigm brief, charging developers with independent acts of others would be as absurd as charging a television manufacturer when secrets of the state are being revealed on-screen. The analogy demonstrates the lack of connection between software development and real-time business.

General Implications to the Software Development

The result of the Tornado Cash Case might have an essential implication on all aspects of open-source development in the United States as well as other industries. General Counsel Gina Moon and Chief legal officer Katie Biber of Paradigm issued a warning that such a step would enable unelected prosecutors to alter the ordinary meaning of criminal laws.

The case puts software developers under the risk of being imprisoned even after engaging in actions supported by widely-publicized regulatory advice. More than 250 corporate leaders governing the industry, such as Bankless co-founder Ryan Sean Adams and Ethereum main developer Tim Beiko, have requested action.

According to the DeFi Education Fund, the Tornado Cash Case has turned into a flashpoint on the issue of criminalizing the act of code-writing itself. Earlier this month, similar questions were brought up during congressional hearings as the Digital Asset Market Clarity Act was reviewed.

The actions of the prosecution pose a danger to innovation within the crypto, fintech, AI and technology communities in general. Software developers might be liable in the misuse of their products by third parties.

Precedent and Federal Regulatory Framework

The Tornado Cash Case adds several decades to the legal precedent that made a distinction between developing software and money transmission. The Treasury Department ruled in 2014 under the Obama administration that software development was not an acceptance and transmission of value.

The 2019 FinCEN guidance particularly took account of the total independent control of crypto as being in control of the users. These regulatory descriptions gave the guideline that developers such as Storm used to develop non-custodial protocols.

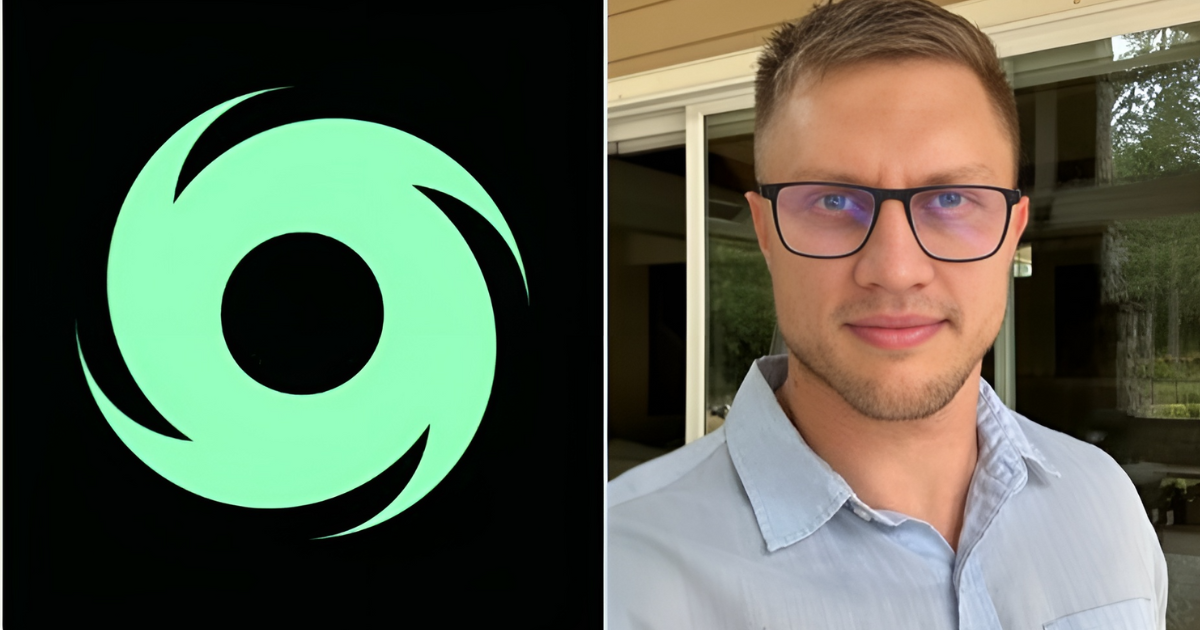

Roman Storm and his co-founder Roman Semenov are charged based on claims of their aid in laundering more than $1 billion using Tornado Cash that started in August 2023. The accusations involve money laundering conspiracy, conspiracy to conduct an unauthorized money transmitter, and violation of sanctions.

Upon conviction, Storm has been charged with the possibility of 45 years in prison in a Tornado Cash case described to be landmark. Remarkably, the Department of Justice dismissed one conspiracy count on May 15, after publishing an April memo, which claimed they would not charge crypto mixers based on user actions.

Conclusion

The Tornado Cash case will be seminal to the field of open-source development and crypto regulation. The July 14 trial of Storm has the potential of setting important legal precedence. The brief by Paradigm encourages the jury to give clear direction in differentiating software development and business. The result may define whether coders would be charged with what users do.