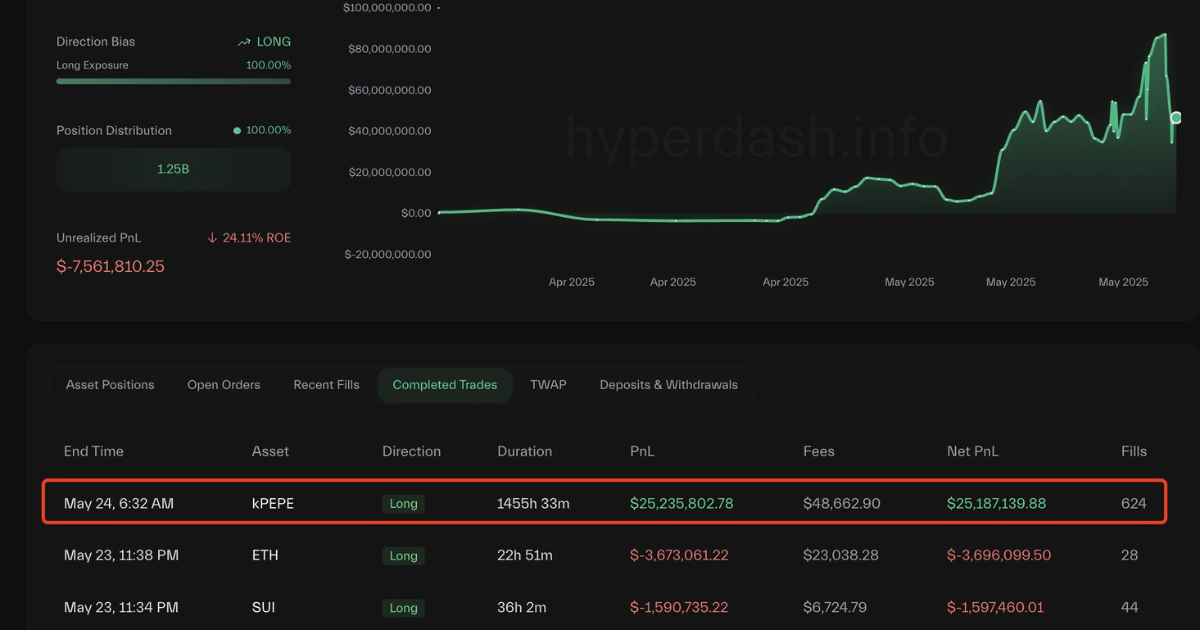

Hyperliquid Trader James Wynn just pulled the plug on a whopping $1.25 billion Bitcoin long, taking a $13.4 million loss in the process. Basically, he “cut [his] losses” as bitcoin slid — a brutal reminder that even big crypto bulls can get burned.

Key Takeaways

- Wynn’s $1.25B Hyperliquid long (40x leverage) closed at a $13.4M loss.

- The trade briefly showed ~$40M in unrealized profit before the exit.

- Bitcoin’s price on Hyperliquid dipped about 1.3% after this sell-off.

- Wynn tweeted he had “cut [his] losses” – proving that big bets carry big risks.

Hyperliquid Trader Cuts Losses on $1.25B BTC Bet

Imagine hanging on to a $1.25B wager and then watching $13.4M evaporate – that’s what happened to one top Hyperliquid Trader this week. The numbers were wild: Wynn’s Bitcoin long was 40x leveraged, meaning a tiny price move could wreck the position.

At one point, he even had over $40 million in paper gains; the rising price of Bitcoin had raised that $1.25 billion. However, as Bitcoin started to lose value, Wynn decided that was enough and gave up. Wynn isn’t new to volatility. He opened this BTC position around $830M on May 21 and then pumped it up as Bitcoin flirted with $110K.

He even took some profits off the table earlier – selling a chunk for a small win – before going all-in to reach the $1.25B mark. The plan was bold, but when a number of market events (including unanticipated tariff worries) sent Bitcoin crashing, Hyperliquid Trader Wynn pulled out to protect what he could. One wrong tick and his account would’ve been wiped (his liquidation price was around $105K).

Bitcoin Price Reaction & Market Impact

Naturally, no one anticipated that a single trader would force Bitcoin to crash, but there were some repercussions. According to on-chain trackers, Hyperliquid’s Bitcoin price slid roughly 1.3% right after Hyperliquid trader Wynn offloaded his massive position. Outside Hyperliquid, bitcoin was already giving back some gains – it dipped from new highs to about $107K on the weekend.

Simply said, the market was somewhat pressured by the sudden drop of 11,588 BTC. It didn’t spark a full crash, but it shows how quickly a single whale’s panic can impact the situation when liquidity is tight.

The market reaction was mixed: a slight pullback on Hyperliquid, and a reminder elsewhere that Bitcoin can’t decouple from big news or big holders.

Still, it’s hard not to stare when a single trade like this gets unwound. Using terms like “liquidity” and “hyperliquid depth,” some traders took to Twitter to mockingly call it the height of the Bitcoin crisis. In summary, people pay attention when a game this important ends.

Trader Reaction & Next Steps

Ultimately, Hyperliquid trader James Wynn appeared to be quite indifferent about the loss. He quipped on social media that he’d trimmed the position and, in his words, “cut [his] losses” – almost like it was just another trade gone wrong.

Other traders had a field day analyzing the move, characterizing it as either a smart risk management approach or a mistake. It demonstrates the dual nature of leverage. One meme coin fan (and risk aficionado) would describe it this way: “Big risk, big learning.” Another risk-averse meme currency enthusiast might put it this way: “massive risk, tremendous learning.”

It’s interesting to note that the news led to a few percent increase in HYPE, the native cryptocurrency of the Hyperliquid platform. As more people visit Hyperliquid, there will be more chatter (and perhaps more new users).

For regular traders, this episode is a lesson in humility. Hype and whale tweets aside, margin trading at 40x is a wild ride. Wynn’s story will probably be cited next time someone says “trust me, this trade is safe.” Spoiler: no trade is without risk.

Conclusion

Through its creative computational techniques, Hyperliquid Trader captures the changing dynamics of cryptocurrencies markets. What are your thoughts on this saga, then? At one point, he even had over $40 million in paper gains; the rising price of Bitcoin had raised that $1.25 billion. However, as Bitcoin started to lose value, Wynn decided that was enough and gave up. Would you dare wager $1.25 billion on Bitcoin?