With increasing ETF inflows, Ethereum has recently jumped by 8% and crossed above $2,700 for the third time this year. With this rally, ETH has reached its best price since May 29, giving a 13.3% boost from its lowest weekly point and making a 12-day high.

Key-Takeaways:

- ETF inflows reached $900 million over 16 consecutive days, with BlackRock accumulating $500 million worth of ETH and maintaining 23 days without outflows.

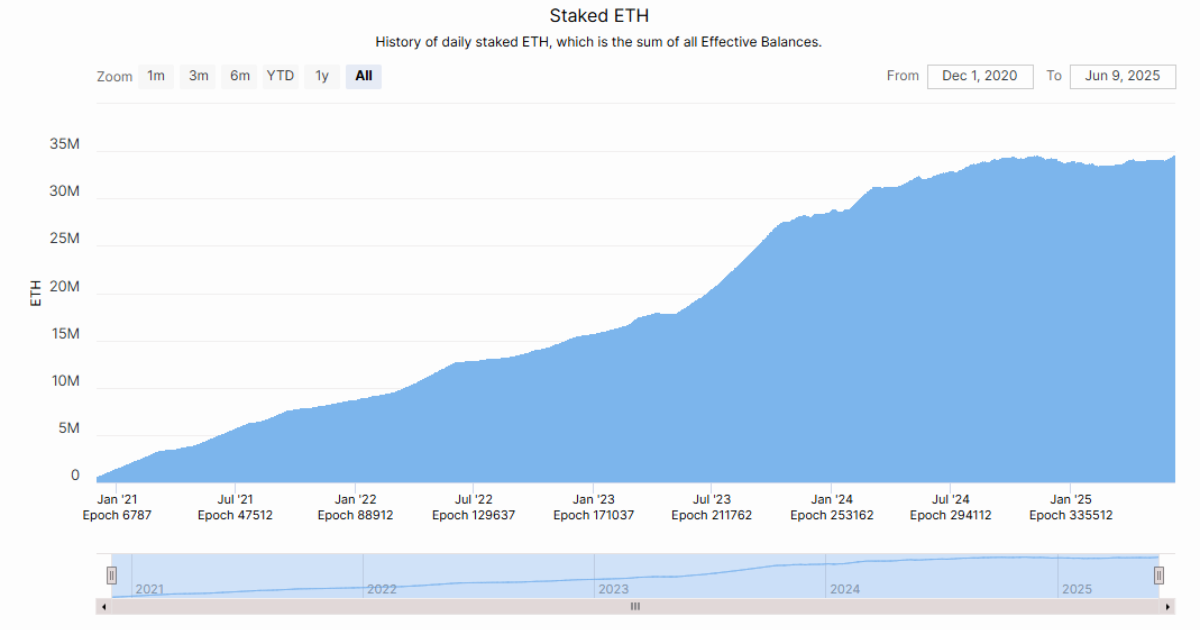

- Record staking activity hit 34.65 million ETH (30% of total supply), creating favorable supply-demand dynamics by reducing available trading supply.

- Ethereum broke key resistance at $2,700 with bullish divergence patterns suggesting potential targets of $3,100-$3,600, though maintaining support above $2,386 remains crucial.

Institutional Investment Provides Strength to the Market

At the same time, strong institutional buying is happening while ETF inflows continue to show that investors are positive about Ethereum’s future. For sixteen straight days, investors have put in nearly $900 million into Ethereum-based exchange-traded funds, reaching a total of $3.38 billion by now.

The BlackRock iShares Ethereum Trust, known as ETHA, has gone on 23 straight trading days without record outflows. Recently, the asset management company has bought over $50 million worth of ETH, reaching a total of 1.5 million ETH valued at $2.71 billion. These large ETF inflows show that institutional investors are interested in Ethereum.

Digital asset manager Abraxas Capital contributed more to the trend by purchasing roughly 350,000 ETH worth $837 million in May. The flows of funds from large institutions into ETFs reflect how Ethereum is more and more widely viewed as a reliable investment asset.

Measuring Staking Makes the Network More Secure

Staking on the Ethereum network has reached massive figures, as over 34.65 million ETH is now staked on the Beacon Chain, based on information from Beaconcha.in. This amount is about 30% of the 120.8 million Ethereum tokens in circulation, which is the highest number of participants the network has ever seen.

The high amount of ETH locked for staking reflects that long-term people prefer to gather rewards instead of selling their coins, which suggests more confidence in Ethereum. This trend matches the current ETF inflows by decreasing the supply in circulation, further securing the network, and making it more decentralized.

Strong record staking and consistent ETF inflows lead to improvements in the supply-demand situation. As Ethereum is locked up in staking and other asset portfolios, there is less available to trade, which may push down the supply and raise the price.

Technical Analysis Shows That Prices Could Increase

Looking at the technical details, Ethereum is above the midline of the Gaussian Channel and its momentum indicators are currently showing bullish signs. The Relative Strength Index (RSI) is now in neutral range and climbing, while the MACD is continuing to rise in the positive zone.

A bullish divergence is seen now that resembles setups that broke out into major rallies in 2020 and 2023. With existing trends and ETF inflows, analysts estimate that Bitcoin prices could hit anywhere from $3,100 to $3,600.

The immediate resistance zone is found between $2,740 and $2,750. A clear move above $2,750 may take ETH to $2,840 resistance and further bullish pressure could drive it up to $2,880 to $2,920. The significant trend line is offering support to price at $2,540 on hourly charts.

Even with the recent growth from ETFs and staking, Ethereum is just about 40.9% down from its all-time high of $4,600. Historically, the $2,700 level has served as a strong barrier, and for the market to keep rising, it needs to overcome $2,737 in one decisive step.

As long as buying from institutions keeps up and the market conditions are positive, further growth is expected. Yet, not maintaining the current support trend might lead to losses. If ETH breaks through the $2,386 support, it may cause the short-term bullish setup to fail and might lead to a stronger price fall.

The initial area of support is the $2,580 zone, which coincides with the 61.8% Fibonacci retracement of the rise we have recently seen. A drop under this number may bring prices closer to $2,540, and from there, further falls could aim for the $2,450 to $2,400 zones.

Conclusion

Ethereum’s price over the next few weeks will likely reflect ETF inflows, since institutional demand and changes within the blockchain as well as the greater crypto market are also influencing investment decisions.

Is enough attention from institutions likely to result in ETH’s significant growth? We would like to hear your thoughts.