In less than 72 hours, Nakamoto Holdings closed a private placement of over $51.5 million. The firm, established by David Bailey, who is the crypto advisor of Trump, is developing its strategy on having a Bitcoin treasury. This raises the invested commitments to approximately 763 million dollars.

Key-Takeaways:

- The assets under management increased to $763 million within 72 hours after Nakamoto Holdings received an institutional backing of over 51.5 million.

- The merger with the KindlyMD (ticker: NAKA) will allocate funds towards acquiring and conducting Bitcoin transactions, making Nakamoto even more cryptocurrency-oriented.

- There are more than 220 companies that currently have Bitcoin on their treasury but the volatility and regulation remains a significant issue.

Fast Capital Deployment Plan

Nakamoto Holdings offered the financing at $5.00 per share subject to merger partner KindlyMD. The healthcare services company will complete the transaction with the authorization of shareholders.

KindlyMD has the ticker NAKA on the Nasdaq stock exchange. The merged company will apply the proceeds mainly in purchasing Bitcoins and working capital needs.

David Bailey indicated the high level of interest by investors in the strategy developed by Nakamoto Holdings. In response to the fast subscription, Bailey said: “There is tremendous investor interest in Nakamoto.” The firm continues to stay strategic in its stance of gaining as many Bitcoin holdings as possible. Nakamoto Holdings is a reflection of effective corporate treasury practices that were achieved by other big companies.

Corporate Trend in Bitcoin Treasury

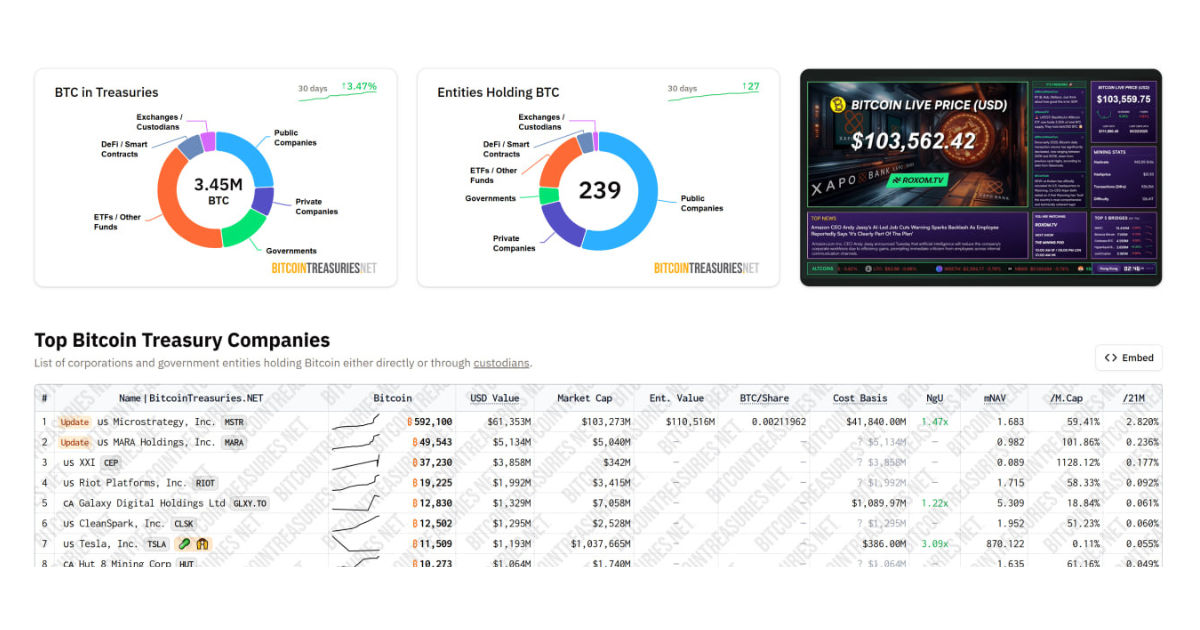

According to public filings, more than 230 companies currently have formal Bitcoin treasury strategies in place. The BitcoinTreasuries.net data indicate that at least 27 organizations have added Bitcoin in the recent past.

Nakamoto holdings is not the first established company to join in this trend as others include MicroStrategy. The companies regard Bitcoin as a treasury reserve and inflation hedge.

Last month, the merger of KindlyMD and Nakamoto Holdings was approved by the shareholders. The transaction between the two companies will be concluded after submitting SEC information statements. The merging process will be completed in Q3 2025. On May 12, 2025, Nakamoto Holdings disclosed the initial merger plan.

Even with institutional interest, analysts caution on possible risks to Nakamoto Holdings and other firms of its kind. Standard Chartered expressed its worries concerning the liquidation risk in case Bitcoin crashes below 90,000.

Fifty percent of the treasury companies in Bitcoin may experience issues of reputation when the market enters a downward swing. The small enterprises might not have adequate protection as the established companies.

According to Fakhul Miah, GoMining Institutional, some companies are bitcoin adopters out of necessity as opposed to strategic thinking. Volatility in the market is one of the issues that corporate treasury management is worried about.

Bitcoin accumulation strides are complicated with regulatory uncertainties. Nakamoto Holdings will have to overcome these difficulties during the course of implementing its acquisition strategy.

Nakamoto Holdings intends to grow Bitcoin native companies and treasury building. The resulting company will combine equity, debt and other source of finance. The new round of working capital helps to expand its operations. The company continues to set high targets of acquiring Bitcoins regardless of the conditions of the market.

The recent $51.5 million capital raise shows ongoing institutional belief in the strategy of Nakamoto Holdings. The 72-hour fill means that there is high market demand of Bitcoin exposure. The company is gearing towards a long term growth in cryptocurrency. By the end of 2025, Nakamoto Holdings is likely to complete its merger and commence expanded activities.

Conclusion

Nakamoto Holdings has become a major resource when it comes to corporate Bitcoin treasury strategies, with a high level of confidence among institutional investors. It still aggressively buys Bitcoin with pledged capital of $763 million. Though the firm faces risks in the market, it remains on track as far as realizing its crypto investment dream is concerned.