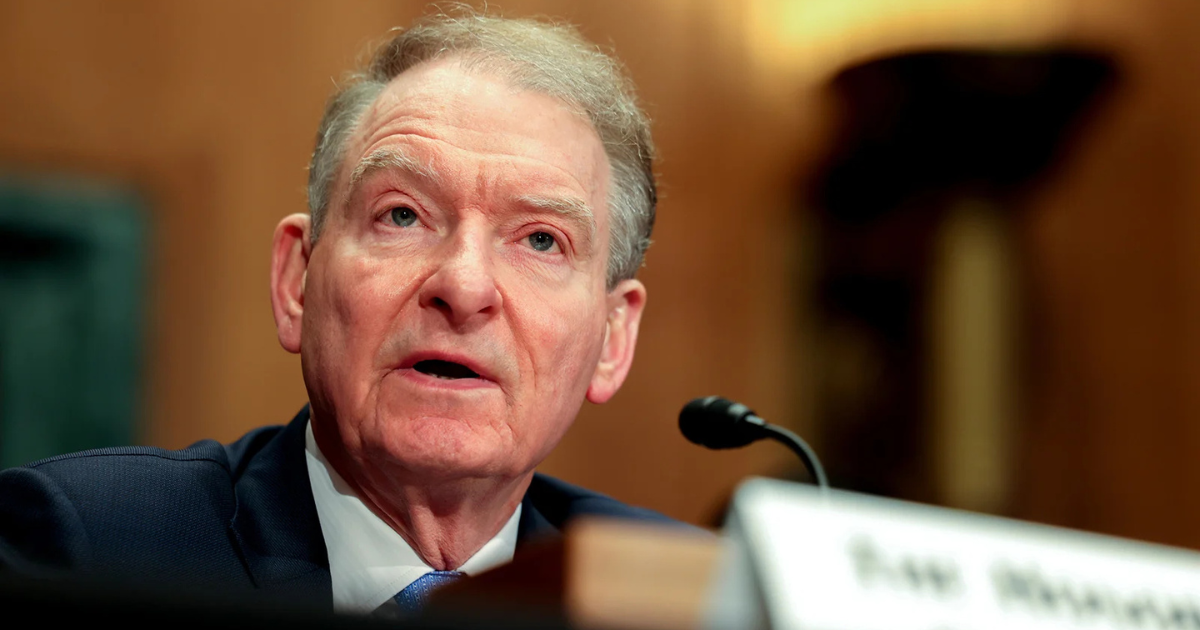

At the April 25, 2025 crypto roundtable, SEC Paul Atkins sent a major signal that the agency is going to change its tune about crypto. Atkins attacked past policies fraught with uncertainty before going on to say that the cryptocurrency industry has been screaming for clearer, more balanced regulations.

Key-Takeaways:

- At a roundtable in April 25, 2025, SEC Paul Atkins pledged to be more certain than ever before, saying: ‘We are moving from uncertainty sponsorship to being uncertain sponsors, however you want to say it.’

- This caused a wave of Bitcoin and all crypto stocks rising, a sign that investors were more confident. If his focus is on modernizing custody rules, this could unlock institutional investment as well as venture capital into crypto space.

SEC Paul Atkins Rails Against Previous Approach of Defense First

SEC Paul Atkins opened in his opening remarks at the SEC’s Crypto Task Force roundtable, where he mentioned the regulatory failures of the past administration. ‘For the last several years, we’ve stymied innovation with uncertainty in the market and regulation that unfortunately went under the share of the SEC,’ he said.

SEC Paul Atkins opened in his opening remarks at the SEC’s Crypto Task Force roundtable, where he mentioned the regulatory failures of the past administration. ‘For the last several years, we’ve stymied innovation with uncertainty in the market and regulation that unfortunately went under the share of the SEC,’ he said.

Atkins specifically took issue with the previous chairman’s regulation via enforcement ethic. Many industry participants had criticized his policies as being too hostile to innovation, and he referred to Gary Gensler’s policies.

Atkins, who reportedly possesses between $600,000 and $6 million in digital assets, reiterated the need for regulatory rules and added that the very activities behind the association represent a serious public policy issue. The SEC’s stance in the past few years has been about uncertainty, and they said market people deserve certainty, he said.

When faced with the bright lights of the roundtable, on all knees as it were, this offered Atkins the perfect chance to preach his vision. In this regard, he detailed what he decided to do to build a more constructive relationship between the regulatory body and the cryptocurrency industry.

Atkins’ comments are indicative that the SEC is willing to reform its relationship with the digital asset space.

Once Atkins spoke, the tone of the message had precedent, and Bitcoin’s market sentiment quickly shifted with Bitcoin above $95,000. The withdrawal of the SEC’s long-running lawsuit against Ripple went a long way to reinforcing that this change of direction would be supported by practical steps, not merely rhetoric.

In the roundtable, SEC Paul Atkins promised to come up with a rational, fit-for-purpose regulatory framework for cryptocurrencies. According to him, it is key to create rules that are practical but also supportive of innovation in the digital asset space.

Unlike his predecessor, Atkins promised to work with both the Trump Administration and with market participants and Congress rather than to continue enforcement first. He is aiming to craft sensible regulations of the right sort of balance, letting innovation thrive while protecting investors.

SEC Paul Atkins said he is looking forward to working with market participants and colleagues in the President Trump’s Administration and Congress to develop a rational, fit-for-purpose regulatory regime for crypto assets. It is an expression of a holistic view of cryptocurrency regulation by the government.

Specifically, SEC Paul Atkins told the crowd during his remarks to commend Commissioner Hester Peirce for her ‘tireless advocacy’ of common sense crypto policy. He added his confirmation that she was ‘the right person to play a philosophical role in finding a reasoned regulatory regime for crypto asset markets.’

This is palpable evidence that the ‘Crypto Mom’—as’ industry also often abbreviates Commissioner Peirce—will work as a key to the SEC’s approach concerning digital assets. But her influence will be one of the factors ensuring that Atkins’ leadership will result in a better balanced regulatory environment.

Market Impact and Investment Implications

Investors were relieved that SEC Paul Atkins’ comments sparked immediate market reaction and that it buoyed optimism of an impending resolution of the two SEC commissioners’ stalemate.

Investors were relieved that SEC Paul Atkins’ comments sparked immediate market reaction and that it buoyed optimism of an impending resolution of the two SEC commissioners’ stalemate.

The second realization caused crypto-adjacent equities to jump 2-4% on higher basis point levels to reprice risk models that do not take into account the reduced regulatory threat.

They suggest this could be the start rather than the end […] and that big assets could benefit 10–15% further. COVID-19 has triggered a ‘headline-risk discount’ from the risk discount, which endures, and as it gets priced out of the market, digital assets look increasingly positive.

If modernizing broker-dealer custody rules passes under SEC Paul Atkins’ radar, it may be a game changer for institutional investment. Addressing this critical roadblock for Atkins would be able to unlock substantial capital flows from traditional finance into the cryptocurrency ecosystem.

For many banks and registered investment advisors, offering crypto services has been an issue of custody solutions. This issue could be addressed over the next few months to help pave the way for institutional use of digital assets.

SEC Paul Atkins’ promise of regulatory clarity for the cryptocurrency space would also reignite venture capital in the cryptocurrency space. Crypto VC keeps on raising money, though it’s been doing so cautiously, and, currently, crypto VC raised $4.8 billion in Q1 2025.

“A clear rule book could ‘unfreeze sidelined U.S. capital’ and double the current fundraising run rate by year-end,” say industry experts. This would attract billions of investment to the cryptocurrency industry.

Global Competitiveness

In part, SEC Paul Atkins seems to have an approach aimed at keeping US competitiveness in the global digital asset space. A recent news item was pointing to the fact that billions of things in crypto have moved to jurisdictions where they have clear regulatory frameworks.

In part, SEC Paul Atkins seems to have an approach aimed at keeping US competitiveness in the global digital asset space. A recent news item was pointing to the fact that billions of things in crypto have moved to jurisdictions where they have clear regulatory frameworks.

Among the regions that fall under these are those working under the European Union’s Markets in Crypto-Asset (MiCA) regime. SEC Paul Atkins sets up the rationale in the US by proposing a more transparent regulation of the rapidly developing sector and ultimately restoring American leadership in it.

Currently, market players foresee a string of mileage markers within the following two years. Among these is a market structure bill potentially passing in June (and consideration by the Senate in September).

There is also pending the publication of a safe harbor rule by Q4, 2025, and the first alternative cryptocurrency ETF approvals by early 2026. If these developments occur under the SEC’s Paul Atkins’ leadership, they can shift the U.S. crypto landscape drastically.

Industry insiders say there are rising expectations of mergers and acquisitions, inasmuch as conventional financial institutions may look to purchase crypto-native companies. These institutions can quickly enhance their capabilities in the cryptocurrency space by consolidating such assets.

Such moves would only make it easier to introduce and integrate cryptocurrencies into the normal financial system. The objective of this development coincides with SEC Paul Atkins vision for balanced regulation, which is intended to balance the interests of investors with the fostering of innovation.

Conclusion

SEC Paul Atkins has turned what was said in a speech to the industry roundtable into a pivotal moment for U.S. crypto regulation. This is the start of a new era of digital assets in America by shifting from enforcement to collaborative rulemaking.