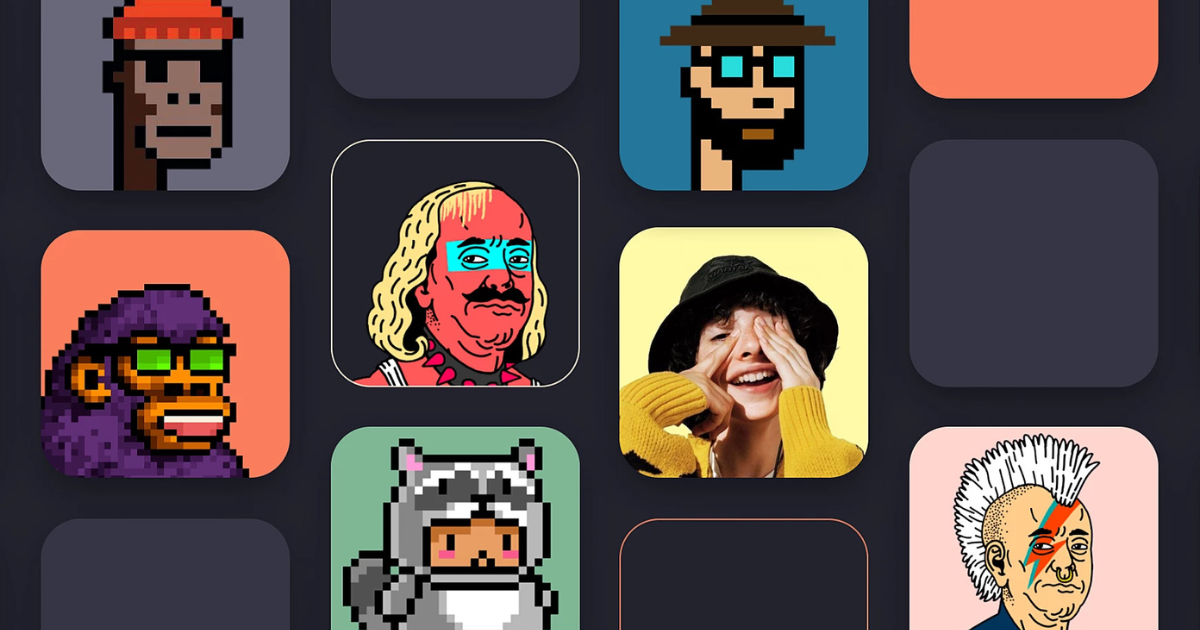

After months of uncertainty, the NFT market is on the path to recovery. In the past quarter, CryptoPunks surge in valuation by 140 percent. As the NFT trends grew, so did other sales, accruing $102.8 million in weekly NFT spend.

Key-Takeaways:

- The value of CryptoPunks surge 140% as they turn into a market leader among NFTs.

- NFT sale volume has bounced back to $102.8 million per week, which is a 4.5% increase that symbolizes trust from the investors.

- Nearly 40 percent of the transaction volume for gaming and metaverse related NFTs and digital land sales are rising.

- The market has shifted to speculation less, utility more, community more and artistic merit more, which is promising a more sustainable recovery.

CryptoPunks Lead the NFT Renaissance

However, it seems that nothing can stop CryptoPunks surge the digital collectibles realm with an overwhelming voice. Recently, the iconic pixel art collection has performed well surpassing most of the cryptocurrency assets. Despite wider market fluctuations, investors and collectors are in a rush to buy these digital assets.

However, it seems that nothing can stop CryptoPunks surge the digital collectibles realm with an overwhelming voice. Recently, the iconic pixel art collection has performed well surpassing most of the cryptocurrency assets. Despite wider market fluctuations, investors and collectors are in a rush to buy these digital assets.

A number of CryptoPunk sales that previously set records have also been made, with a single one going for more than $7 million. This is the highest paid so far for a digital collectible in 2025. Since December the collection’s floor price ranges sixfold from 20 ETH to 70 ETH to more than double at 45 ETH with a 2% volume now.

CryptoPunks have appeared in the world’s major galleries and museums as digital art in exhibitions around the world. As such, these digital assets have further received mainstream recognition that has cemented their blue-chip status. Also, fashion brands and entertainment companies are also looking to partner with CryptoPunk owners.

NFT Market Recovery Gains Momentum

Sales of the NFT sector increased by 4.5 percent weekly and it is a remarkable turnaround from last year. The confidence buyer confirms the digital collectibles continue to have a meaningful address in the wider market in 2022 as the total volume exceeded $102.8 million. Trading has picked up on most marketplaces from OpenSea, Blur, to X2Y2.

Sales of the NFT sector increased by 4.5 percent weekly and it is a remarkable turnaround from last year. The confidence buyer confirms the digital collectibles continue to have a meaningful address in the wider market in 2022 as the total volume exceeded $102.8 million. Trading has picked up on most marketplaces from OpenSea, Blur, to X2Y2.

Maya Chen says that “the NFT market is undergoing a renaissance based on real utility and tremendous artistic merit.” New collectors are drawn to the falling gas fees and better marketplace user experience. Like in institutional investing, some capital is also being allocated to curated NFT collections.

Almost 40% of recent transaction volume comes from gaming and metaverse-related NFTs. Major tech companies have not only begun offering digital land for sale but also sales for virtual land have surged. Another high-growth category has been music NFT and many record labels have launched token-gated experiences.

Emerging Projects Challenge Established Collections

Several new projects are making a strong impact while CryptoPunks ride in the front seat. Market attention has been brought to AI generated art collections with their unique aesthetics and rare algorithms, and certain collectors have even made the jump to invest in AI-generated art auctions. Projects driven by and giving strong utility are attracting long-term holders rather than speculators.

Several new projects are making a strong impact while CryptoPunks ride in the front seat. Market attention has been brought to AI generated art collections with their unique aesthetics and rare algorithms, and certain collectors have even made the jump to invest in AI-generated art auctions. Projects driven by and giving strong utility are attracting long-term holders rather than speculators.

Traders have noticed the AGNT token from the Codename ecosystem. In this case, AI-powered trading tools are paired with an innovative approach designed around both the functionality of NFTs. Strong investor interest in utility-focused tokens appears to be the reason why its presale stages have always sold out.

Market Outlook Remains Positive Despite Challenges

Premium NFT collections are predicted to continue to grow for the rest of 2025. They caution that however this market recovers, not all projects will benefit equally. Specifically, fundamentally sound collections with established reputations will tend to outperform speculative offerings, collections with strong communities, and truly valuable and utility collections balanced off against the speculative utility of their stuff.

Premium NFT collections are predicted to continue to grow for the rest of 2025. They caution that however this market recovers, not all projects will benefit equally. Specifically, fundamentally sound collections with established reputations will tend to outperform speculative offerings, collections with strong communities, and truly valuable and utility collections balanced off against the speculative utility of their stuff.

The picture, in large part, stems from regulatory developments that are shaping the evolving NFT space across the world. It has become clearer for several countries to tax the way and transfer digital collectibles. In fact, these regulatory clarifications have given more institutional participation in the market.

Conclusion: CryptoPunks Surge

CryptoPunks’ values in particular and the broader NFT market. Sure enough, the sector has clearly cleared its bear market lows — weekly sales volume reached $102.8 million. CryptoPunks’ 140% price increase serves as a powerful indicator of changing market sentiment.

Investors and brands from both the traditional and newer areas are jumping in, and given time is on its side, further growth is likely. As these speculations have been spreading rapidly, what can you say towards this?