In the past 24 hours, large investors, also known as whales, have collectively struck 5.52 million Solana (SOL). These tokens are worth approximately $810 million. At the same time, 3.54 million Solana, worth approximately $516 million, was deposited on Coinbase Prime. This is a platform that is mainly used by professional traders and large investors. These movements can influence the Solana price. So what can we expect now?

Whales unstake Solana en masse

If so many Solana are unstaked at once and sent to an exchange, it can create selling pressure. Yet the Solana price has remained surprisingly stable. This indicates that these whales are not immediately selling their tokens, but are adjusting their strategy.

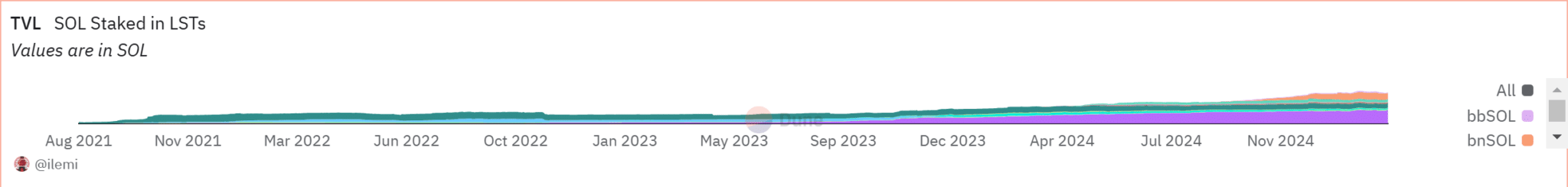

An important indicator is the total value of all staked Solana on liquid staking platforms (LSTs). Despite the large unstaking in the past few hours, this TVL (Total Value Locked) remained stable. This shows that it concerns a few large accounts and not a massive outflow of stakers. It seems that these whales are rearranging their positions, while most stakers retain their confidence in Solana.

Looking at the longer term, we see that the amount of Solana in liquid staking platforms has even grown over the past year. There were short periods of decline, but the general trend is positive. At the moment, there is approximately 37 million Solana locked in staking via these platforms.

Previous data shows that large unstaking events do not always cause the Solana rate to fall. Often, the tokens simply remain on the exchange after unstaking, or they are used for other investments within the Solana ecosystem. This limits the impact on the exchange rate.

How will the Solana price react?

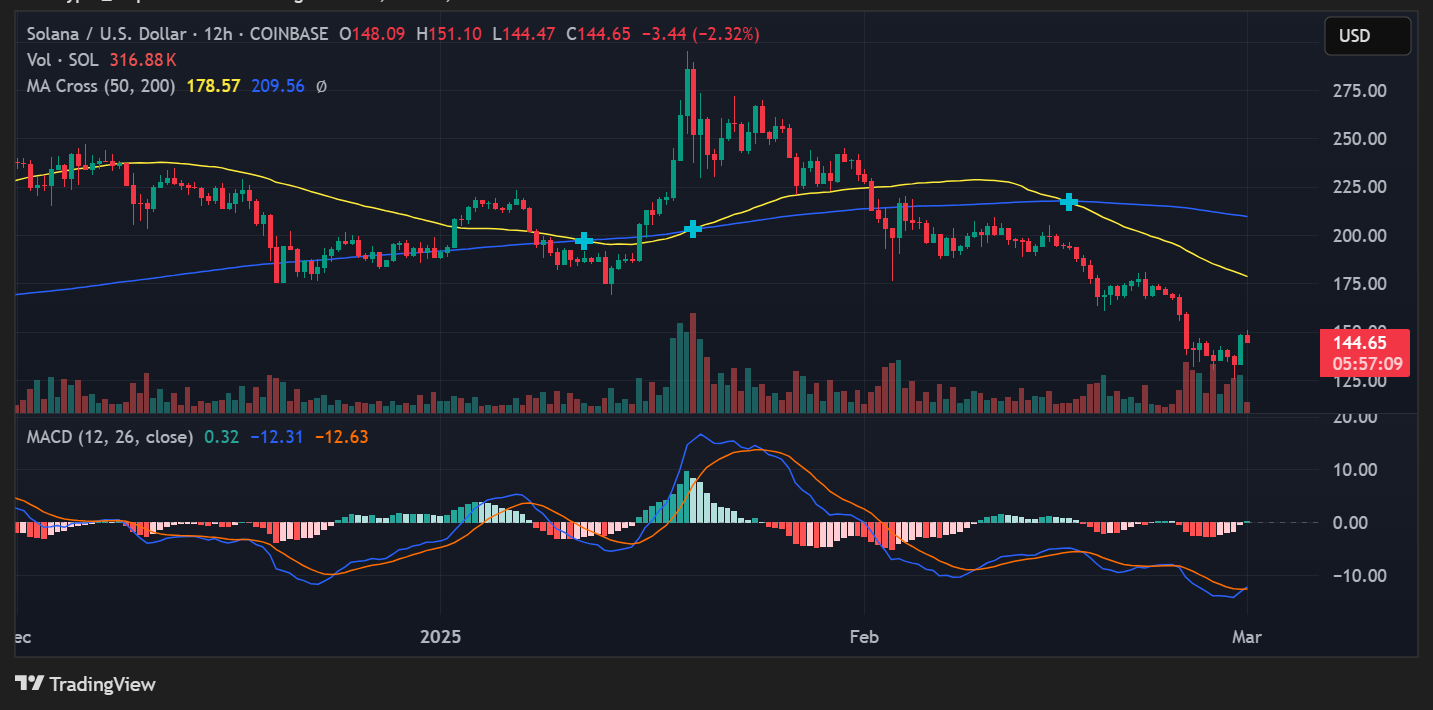

Despite the movements of the whales, the Solana price is currently showing resilience. After a brief dip, the price quickly recovered to around $144. After that, the price fell back slightly, but there is no question of panic selling. Technical indicators paint a mixed picture. The MACD indicator shows that selling pressure is easing slightly. At the same time, average prices over the longer term are still trending downwards. This means that traders are still cautious. The most important conclusion is that the Solana price has remained stable so far, despite the millions of unstaked tokens and the large deposits on Coinbase Prime. This suggests that there is enough demand to absorb the additional supply.

What happens next depends on the behavior of these whales. If they stake their tokens again or invest in DeFi projects, the impact on the Solana rate may remain limited. But if more large unstakes follow without new buying interest, the Solana rate may still come under pressure.