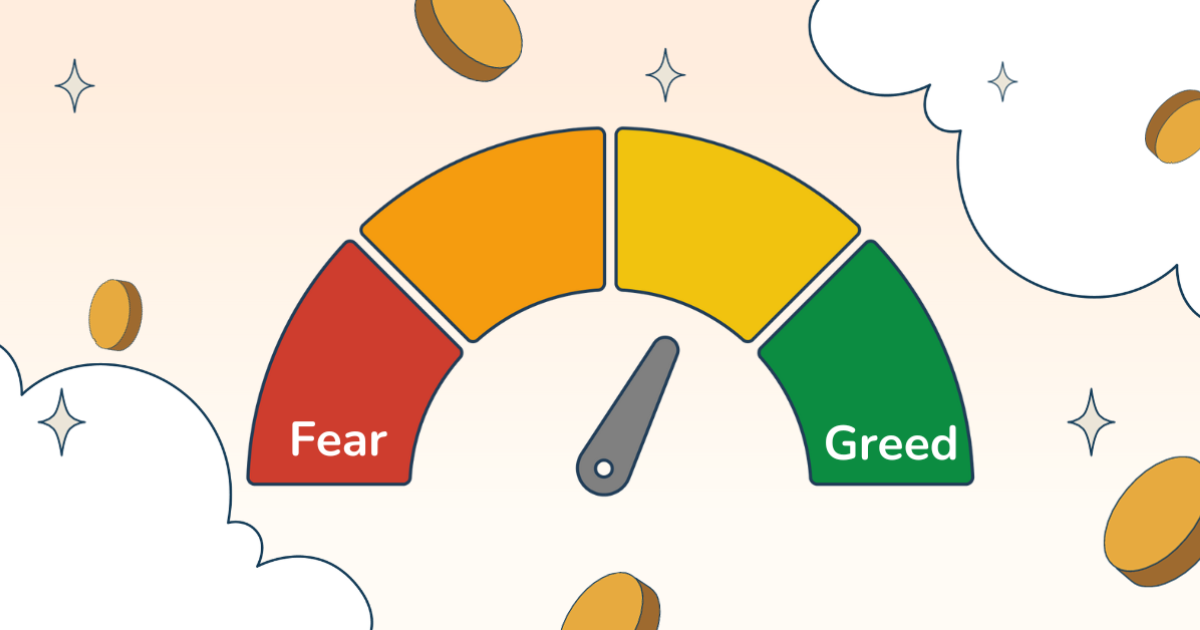

The Bitcoin Fear and Greed Index is helpful to investors by indicating the state of the cryptocurrency market’s emotions. This is a powerful tool that converts complex market data into a single score of 0 to 100. Investors will be better served if they can track market sentiment to make more informed decisions about their cryptocurrency investments.

Key-takeaways:

- The Bitcoin Fear and Greed Index uses market data to create a 0-100 score that tells you if the market is in fear or greed mode.

- Holding extreme fear (below 25) usually means already missed an opportunity to buy at its low, whereas extreme greed (above 75) shows that a market correction may happen soon.

- Though useful, the index shouldn’t be used as a standalone indicator for trading, but rather as a compliment to other analysis.

How does Index Work?

Every day it captures Bitcoin market sentiment through multiple data points. A reading below 25 means that the market is falling into extreme fear, and anything over 75 is extreme greed. To get a complete picture of how the market feels, the system pulls information from several sources. Market volatility, trading volume, social media activity, and Bitcoin’s market dominance are all also sources.

Every day it captures Bitcoin market sentiment through multiple data points. A reading below 25 means that the market is falling into extreme fear, and anything over 75 is extreme greed. To get a complete picture of how the market feels, the system pulls information from several sources. Market volatility, trading volume, social media activity, and Bitcoin’s market dominance are all also sources.

How volatile the market is determines whether investors fear or are greedy. Price swings occur suddenly, so sudden price swings often signal fear; steady upward movement signals growing confidence. But trading volume provides another level of insight—the more people trade on Bitcoin, the more actively people are buying and selling Bitcoin. During price increases, high trading volumes are usually associated with greedy market behavior.

Social Media’s Impact on the Index

The index measures what is being said about Bitcoin over social channels. The greed score tends to rise when more people online talk positively about Bitcoin. Google Trends data does a similar trick when used to measure the public’s interest in Bitcoin through search patterns. Generally, rising search volumes mean that there’s interest or concern on the market.

The index measures what is being said about Bitcoin over social channels. The greed score tends to rise when more people online talk positively about Bitcoin. Google Trends data does a similar trick when used to measure the public’s interest in Bitcoin through search patterns. Generally, rising search volumes mean that there’s interest or concern on the market.

This index is used by smart traders as one tool to make their moves plan. Lots of investors think that extreme fear is an opportunity to buy. During these periods, the market can be overly sold in panic. On the other hand, huge greed could warn investors that a market correction might be around the corner. The index, however, works best when it is paired with other analysis tools.

This index is showing interesting patterns of how emotions affect cryptocurrency markets. During price drops, fear can spread quickly, which means that more people will also sell their Bitcoin. Not to mention greed during a bull run, as investors just want to buy more. The truth is that emotional cycles are played out time and time again through the history of Bitcoin.

Benefits for Different Types of Investors

The index regularly gets checked by day traders searching for short-term trading opportunities. Usually, the long-term investor uses it to find good entry points for building their positions. Watching how the index changes can teach new crypto investors market timing. It makes it easier for everyone to understand market sentiment.

The index regularly gets checked by day traders searching for short-term trading opportunities. Usually, the long-term investor uses it to find good entry points for building their positions. Watching how the index changes can teach new crypto investors market timing. It makes it easier for everyone to understand market sentiment.

The index is helpful, but this should not be the only guide to trading decisions. The index may indicate what is happening in markets, but market conditions can change in an instant. Technical analysis combined with market research is the best way to utilize the tool. Keep in mind, though, that past patterns never mean future results.

The cryptocurrency market is evolving the Fear and Greed Index. It’s now part of the daily research routine of more investors. The tool assists in letting the water flow where psychology reigns in a given market. With Bitcoin maturing, however, the index might be gaining even more useful potential in helping us tell the story of market psychology.

Conclusion: Bitcoin Fear and Greed Index

Investors can better gauge market sentiment by using the Bitcoin Fear and Greed Index. However, having the knowledge makes them more balanced with their cryptocurrency investment decisions. Also, don’t forget to treat this tool as just one part of a balanced strategy rather than it being the only thing you use. However, reading through the index is valuable, but it doesn’t make you a successful trader by itself, as there are multiple things you need to factor in.