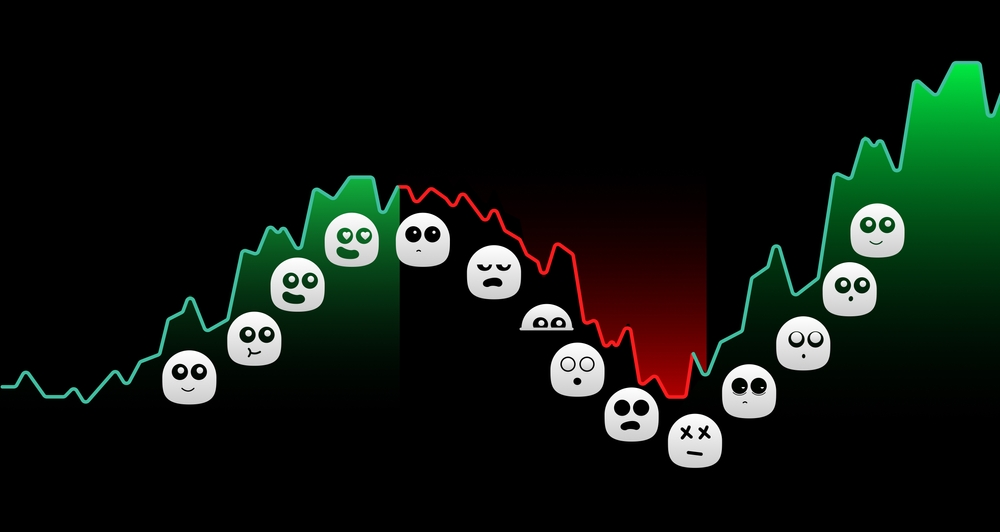

Trading psychology plays a crucial role in determining outcomes in financial markets. It encompasses the emotional and mental factors that influence a trader’s decisions, often shaping the difference between success and failure. The ability to manage one’s thoughts and feelings while navigating market fluctuations can significantly impact trading performance.

Understanding trading psychology involves recognizing how emotions like fear, greed, and anxiety can affect judgment. Traders who develop strong psychological skills are better equipped to handle the pressures of the market, make rational decisions, and maintain discipline in their trading strategies. This mental aspect of trading is just as important as technical knowledge and often becomes a key differentiator among market participants.

Trading Mindset: The Psychology Behind Market Decisions

Key Points

Trading mindset encompasses the emotional and mental factors that influence an investor’s choices in financial markets. It plays a crucial role in determining trading outcomes and can significantly impact profitability.

Key aspects of trading mindset include:

- Emotional regulation

- Decision-making under pressure

- Risk management

- Cognitive biases awareness

Fundamentals of Trading Mindset

The core of trading mindset revolves around managing emotions and maintaining objectivity when making investment decisions. Two primary emotional forces often impact traders:

- Excessive optimism: Can lead to overconfidence and risky behavior

- Unwarranted fear: May cause premature exits or missed opportunities

Successful traders typically strive to:

- Remain calm under pressure

- Base decisions on thorough analysis rather than gut feelings

- Maintain discipline in following their trading plans

- Learn from both wins and losses without becoming overconfident or discouraged

Developing these skills takes time and practice, but can greatly enhance a trader’s ability to navigate volatile markets effectively.

Cognitive Biases in Trading

Cognitive biases can significantly impact trading decisions, often leading to suboptimal outcomes. Some common biases include:

- Confirmation bias: Seeking information that supports pre-existing beliefs while ignoring contradictory evidence

- Recency bias: Giving too much weight to recent events and overlooking long-term trends

- Loss aversion: Being overly cautious due to a fear of losses, potentially missing profitable opportunities

- Overconfidence: Overestimating one’s abilities and knowledge, leading to excessive risk-taking

Traders should actively work to recognize these biases in their decision-making processes. Strategies to counteract biases include:

- Seeking diverse perspectives on market conditions

- Regularly reviewing and challenging one’s own assumptions

- Using objective criteria and data-driven analysis for decision-making

- Maintaining a trading journal to track and analyze patterns in decision-making

By addressing cognitive biases, traders can make more balanced and rational choices in their market activities.

Developing a strong trading mindset helps investors make more rational decisions and potentially improve their performance in the markets.

Trading is more than just recognizing trends and finding good trade setups. As a trader, you have to deal with a lot of emotions (especially in the beginning). Especially when you are just around the corner. Emotions cause you to make the wrong decisions. As a trader you have a certain plan and you have to stick to it over and over again. Emotions cause you to deviate from that plan. If you become euphoric because the price is rising, you will let a trade go on longer and you will not take your profits in time. If you panic because the price is falling, you will leave a trade sooner, with the result that you will miss the subsequent rise.

In short, emotions and trading are a bad marriage. It is not for nothing that 95% of traders make losses. This has purely to do with the fact that most traders do not have enough discipline and cannot distance themselves from their emotions. With this course we are going to help you get to the other 5% of traders. In order to be a successful trader you have to fulfill some important components.

These components are listed below:

Control your emotions

As indicated above, emotions affect your trades. ‘Turning off’ your emotions is easier said than done. But within trading, emotions play a big role. You often see people getting too attached to their crypto investments and therefore find it hard to part with them. They stick to their favorite investments and sometimes see their investments fall by as much as 90% or more. The “HODL strategy” (Hold On for Dear Life) was very effective in the year 2017 and delivered unimaginably high returns. Many altcoins went x10, x100 or even x1000. Since the bear market that followed, people stuck to the dream of getting rich quick. However, they saw their investments rapidly evaporate.

As we head toward the end of the year 2019, we now know that HODLing is no longer profitable, with exceptions. The people making the most money now are not the “HODLaars,” or long-term investors, but the traders. Being able to renounce a trade is very important. If you have a trade plan and the price does not do what you expect, you should be able to take losses. If your stoploss is hit you let go of the project and look for the next opportunity in the market. We still see far too often that people remove their stoploss the moment the price drops towards the stoploss. That action is purely based on emotion. Have confidence in your trade. If the stoploss is hit, your trade is invalid and no longer interesting. On to the next one.

Commit

In general, trading is heavily underestimated. Many people think it is simple, since “he can also trade, so why not me?”. You should quickly put this thought out of your mind! The potential profits to be gained from trading and the luxury of scheduling your own time instead of the 9 to 5 working days exert a great attraction on many people. To achieve that, however, it takes dedication. Not only does it take many hours to master the theory, just like driving a car, you will have to put in a lot of miles to gain the knowledge and experience needed to become a successful trader. Ask yourself the following questions:

- Are you willing to put in that time and energy?

- Are you willing to fight the battle especially with yourself?

- Are you prepared to persevere, even when the going gets tough?

Patience

Most people who invest in cryptocurrencies do so because they want to make money. It is impossible for everyone to make a profit. So logically that also means there are losers in the market. A lot of losers, in fact. Every time you make a profitable trade, there are people on the other side who have lost money. Famous billionaire Warren Buffet, businessman and investor, once made the statement:

“The stock market is a device for transferring money from the impatient to the patient.”

His statement was about the stock market, but also applies to the crypto market and many other markets. It is important to know how to be patient in the market. Let the trades come to you and not the other way around. Making hasty decisions again comes from trading from emotion. Sometimes it takes days or even weeks for the price to drop or rise to a level where making an entry is interesting to you. You don’t always have to be in a trade. No position is also a position.

Risk Management

Trading is nothing else than taking and unwinding risks. Thereby you should not only be able to bear risks financially, but also emotionally. If you take a 15% profit in a week, that is not so difficult to manage. It is much more important to be able to manage a trade emotionally if it goes against you. Then ask yourself the following questions:

- Can you still make the right decisions when you are under pressure?

- Are you in control of your emotions?

- Are you sticking to your trade plan?

Besides managing the emotional aspect, you can also manage your risk on a financial level. This will ensure that you do not have to close all your trades with a profit in order to be successful.

Keep learning

Every action while trading leads to a reaction. Often the reaction is labeled as right or wrong, success or failure. If you know how to turn that thought into “Getting feedback from the market,” it can change your emotional reaction. When you make a profitable trade you get feedback and when you make a losing trade you get feedback. This way of looking at things puts you in learning mode. And that will cause you to become a better and better trader.

How Does Mindset Impact Trading Choices?

A trader’s psychology influences:

• Risk tolerance and position sizing • Ability to follow a trading plan • Reactions to wins and losses • Interpretation of market information • Decision-making under pressure

Emotional stability and discipline play crucial roles in executing trades effectively and managing capital.

What Are Common Mental Traps in Trading?

Traders often fall into these psychological pitfalls:

- FOMO (Fear of Missing Out)

- Revenge trading after losses

- Overconfidence after wins

- Analysis paralysis

- Anchoring to past prices

Awareness of these tendencies and developing coping strategies can improve trading outcomes.

How Is the 1% Rule Applied in Trading?

The 1% rule in trading suggests:

• Risking no more than 1% of account equity on a single trade • Helps preserve capital during losing streaks • Allows for multiple opportunities to profit • Reduces emotional stress from large losses

This approach promotes longevity in trading and helps manage psychological pressure.

Additional Learning Materials

To further develop trading mindset and skills, consider exploring these resources:

- Books on trading psychology:

- “Trading in the Zone” by Mark Douglas

- “The Disciplined Trader” by Mark Douglas

- “Market Wizards” by Jack D. Schwager

- Online courses:

- Behavioral finance modules from reputable financial institutions

- Risk management workshops offered by trading platforms

- Trading simulators:

- Practice implementing strategies without risking real capital

- Experiment with different market conditions and scenarios

- Professional organizations:

- Join trading communities for peer support and knowledge sharing

- Attend industry conferences to network and learn from experts

- Financial news and analysis:

- Follow reputable financial news sources for market insights

- Subscribe to analyst reports from well-regarded research firms

- Technical analysis tools:

- Learn to use charting software and technical indicators

- Understand how to interpret market data effectively

By utilizing these resources, traders can continually refine their trading psychology and improve their decision-making processes in the financial markets.

Find your own strategy

Every person is different and every trader trades in his own way. It is therefore important that you look for what works well for you. Are you someone who likes to be very active and likes to take profits quickly? Then scalptrading may be for you. With scalptrading you look at the low timeframes and make very short trades of a few minutes or hours. You pick up low percentages, but can make many trades in a day.

Are you someone who prefers to be behind the screen as little as possible? Then perhaps trading on the high timeframes is for you. With trading on the high timeframes you follow the price especially on the 4Hours, 1Daily or 1Weekly. You are often much longer in a trade (sometimes days or weeks) and you take much higher percentages than with scalptrading. You also make far fewer trades.